|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

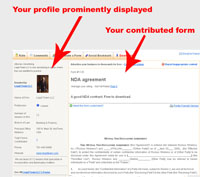

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

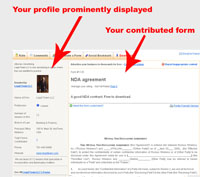

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

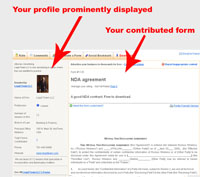

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #1694Comprehensive Security Agreement

|

Average user rating: |

Not Yet Rated

|

Rate it |

|

As security for the prompt and complete payment and performance when due of all of its Obligations (all capitalized terms used herein and defined in Section 9 shall be used herein as so defined), the Assignor does hereby sell, assign and transfer unto the Collateral Agent, and does hereby grant to the Collateral Agent for the benefit of the Banks, a continuing security interest of first priority in, all of the right, title and interest of the Assignor in, to and under all of collateral

|

Need this form customized?

Need this form customized? |

Download This Form

Download This Form

|

Printer Friendly Version

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your

agreement to hold this site, its officers, employees and any contributors to this

site harmless for any damage you might incur from your use of any submissions contained

on this site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice. YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

|

SECURITY

AGREEMENT

This

SECURITY AGREEMENT, dated as of ______, is between ______, a[n] ______ [entity

of assignor] (the "Assignor"), and ______, a[n] ______ [entity of

assignee] (the "Collateral Agent"), as Collateral Agent acting in the

manner and to the extent described in Section ______ of the Credit Agreement

defined below for the benefit of the banks (the "Banks") party to the

Credit Agreement, dated as of ______, among the Assignor, ______, as Agent, and

the Banks (as modified, supplemented or amended from time to time, the

"Credit Agreement"). Unless otherwise defined herein, terms used

herein and defined in the Credit Agreement shall be used herein as so defined.

Recitals

A. WHEREAS,

the Assignor desires to incur Loans under the Credit Agreement;

B. WHEREAS,

it is a condition precedent to the incurrence of Loans under the Credit

Agreement that the Assignor shall have executed and delivered to the Collateral

Agent this Agreement;

C. WHEREAS,

the Assignor desires to execute this Agreement to satisfy the condition

described in the preceding paragraph;

NOW, THEREFORE, in consideration

of the benefits to the Assignor, the receipt and sufficiency of which are

hereby acknowledged, the Assignor hereby makes the following representations

and warranties to the Collateral Agent and hereby covenants and agrees with the

Collateral Agent as follows:

1. Security

Interests

1.1 Grant of

Security Interests

(a) As security for the prompt and complete payment

and performance when due of all of its Obligations (all capitalized terms used

herein and defined in Section 9 shall be used herein as so defined), the

Assignor does hereby sell, assign and transfer unto the Collateral Agent, and

does hereby grant to the Collateral Agent for the benefit of the Banks, a

continuing security interest of first priority in, all of the right, title and

interest of the Assignor in, to and under all of the following, whether now

existing or hereafter from time to time acquired: (1) each and every

Receivable; (2) all Contracts, together with all rights of Assignor arising

thereunder; (3) all Inventory; (4) all Equipment; (5) all Marks, together with

the registrations and right to all renewals thereof, and the goodwill of the

business of the Assignor symbolized by the Marks; (6) all Patents and

Copyrights; (7) all computer programs of the Assignor and all intellectual

property rights therein and all other proprietary information of the Assignor,

including, but not limited to, trade secrets; (8) the Cash Collateral Account

and all monies, securities and instruments deposited or required to be

deposited in the Cash Collateral Account; (9) all other Goods, General

Intangibles, Chattel paper, Documents and Instruments (other than Pledged

Stock); and

(10) all Proceeds and products of any and all of the foregoing (all of the

above, collectively, the "Collateral").

(b) The

security interest of the Collateral Agent under this Agreement extends to all

Collateral of the kind described in preceding clause (a) which the Assignor may

acquire at any time during the continuation of this Agreement.

1.2 Power of

Attorney

The Assignor hereby constitutes

and appoints the Collateral Agent its true and lawful attorney, irrevocably,

with full power after the occurrence of an Event of Default (in the name of the

Assignor or otherwise) to act, require, demand, receive, compound and give

acquittance for any and all monies and claims for monies due or to become due

to the Assignor under or arising out of the Collateral, to endorse any checks

or other instruments or orders in connection therewith and to file any claims

or take any action or institute any proceedings which the Collateral Agent may

deem to be necessary or advisable in the premises, which appointment as

attorney is coupled with an interest.

2. General

Representations, Warranties and Covenants

The Assignor represents,

warrants and covenants, which representations, warranties and covenants shall

survive execution and delivery of this Agreement, as follows:

2.1 Necessary

Filings

All filings, registrations and

recordings necessary or appropriate to create, preserve, protect and perfect

the security interest granted by the Assignor to the Collateral Agent hereby in

respect of the Collateral have been accomplished and the security interest

granted to the Collateral Agent pursuant to this Agreement in and to the

Collateral constitutes a valid and enforceable perfected security interest

therein superior and prior to the rights of all other Persons therein and

subject to no other Liens (except that the Collateral may be subject to Liens

permitted under Section ______ of the Credit Agreement) and is entitled to all

the rights, priorities and benefits afforded by the Uniform Commercial Code or

other relevant law as enacted in any relevant jurisdiction to perfected

security interests.

2.2 No Liens

The Assignor is, and as to

Collateral acquired by it from time to time after the date hereof the Assignor

will be, the owner of all Collateral free from any Lien or other right, title

or interest of any Person (other than Liens created hereby or permitted under

Section ______ of the Credit Agreement), and the Assignor shall defend the

Collateral against all claims and demands of all Persons at any time claiming

the same or any interest therein adverse to the Collateral Agent.

2.3 Other

Financing Statements

There is no financing statement (or similar statement or

instrument of registration under the law

of any jurisdiction) covering or

purporting to cover any interest of any kind in the Collateral except as

disclosed in Annex ______, and so long as the Total Commitment has not been

terminated or any of the Obligations remain unpaid, the Assignor will not

execute or authorize to be filed in any public office any financing statement

(or similar statement or instrument of registration under the law of any jurisdiction)

or statements relating to the Collateral, except financing statements filed or

to be filed in respect of and covering the security interests granted hereby by

the Assignor.

2.4 Chief

Executive Office; Records

The chief executive office of the

Assignor is located at ______, ______, ______ ______. The Assignor will not

move its chief executive office except to such new location as the Assignor may

establish in accordance with the last sentence of this Section 2.4. The

originals of all documents evidencing all Receivables and Contracts of the

Assignor and the only original books of account and records of the Assignor

relating thereto are, and will continue to be, kept at such chief executive

office or at the locations disclosed in Annex ______, or at such new locations

as the Assignor may establish in accordance with the last sentence of this

Section 2.4. All Receivables and Contracts of the Assignor are, and will

continue to be, maintained at, and controlled and directed (including, without limitation,

for general accounting purposes) from, such office locations shown above, or

such new locations as the Assignor may establish in accordance with the last

sentence of this Section 2.4. The Assignor shall not establish a new location

for such offices until (a) it has given to the Collateral Agent not less than

[spelled number of days] (______) days' prior written notice of its intention

so to do, clearly describing such new location and providing such other

information in connection therewith as the Collateral Agent may reasonably

request, and (b) with respect to such new location, it shall have taken all

action, satisfactory to the Collateral Agent, to maintain the security interest

of the Collateral Agent in the Collateral intended to be granted hereby at all

times fully perfected and in full force and effect.

2.5 Location of

Inventory and Equipment

All Inventory and Equipment held

on the date hereof by the Assignor is located at one of the locations shown on

Annex ______. The Assignor agrees that all Inventory and Equipment now held or

subsequently acquired by it shall be kept at (or shall be in transport to) any

one of the locations shown on Annex ______, or such new location as the

Assignor may establish in accordance with the last sentence of this Section

2.5. The Assignor may establish a new location for Inventory and Equipment

only if (a) it shall have given to the Collateral Agent prior written notice of

its intention so to do, clearly describing such new location and providing such

other information in connection therewith as the Collateral Agent may

reasonably request, and (b) with respect to such new location, it shall have

taken all action reasonably satisfactory to the Collateral Agent to maintain

the security interest of the Collateral Agent in the Collateral intended to be

granted hereby at all times fully perfected and in full force and effect.

2.6 Recourse

This Agreement is made with full recourse to the Assignor

and pursuant to and upon all the

warranties, representations,

covenants and agreements on the part of the Assignor contained herein, in the

Credit Agreement and otherwise in writing in connection herewith or therewith.

3. Special

Provisions Concerning Receivables; Contracts; Instruments

3.1 Additional

Representations and Warranties

As of the time when each of its

Receivable arises, the Assignor shall be deemed to have represented and

warranted that such Receivable, and all records, papers and documents relating

thereto (if any) are genuine and in all respects what they purport to be, and

that all papers and documents (if any) relating thereto (a) will represent the

genuine, legal, valid and binding obligation of the account debtor evidencing

indebtedness unpaid and owed by the respective account debtor arising out of the

performance of labor or services or the sale or lease and delivery of the

merchandise listed therein, or both, (b) will be the only original writings

evidencing and embodying such obligation of the account debtor named therein

(other than copies created for general accounting purposes), (c) will evidence

true and valid obligations, enforceable in accordance with their respective

terms and (d) will be in compliance and will conform with all applicable

federal, state and local laws and applicable laws of any relevant foreign

jurisdiction.

3.2 Maintenance

of Records

The Assignor will keep and

maintain at its own cost and expense satisfactory and complete records of its

Receivables and Contracts, including, but not limited to, the originals of all

documentation (including each Contract) with respect thereto, records of all

payments received, all credits granted thereon, all merchandise returned and

all other dealings therewith, and the Assignor will make the same available to

the Collateral Agent for inspection, at the Assignor's own cost and expense, at

any and all reasonable times upon demand. The Assignor shall, at its own cost

and expense, deliver all tangible evidence of its Receivables and Contracts

(including, without limitation, all documents evidencing the Receivables and

all Contracts) and such books and records to the Collateral Agent or to its

representatives (copies of which evidence and books and records may be retained

by the Assignor) at any time upon its demand. If the Collateral Agent so

directs, the Assignor shall legend, in form and manner reasonably satisfactory

to the Collateral Agent, the Receivables and Contracts, as well as books,

records and documents of the Assignor evidencing or pertaining to the Receivables

or Contracts with an appropriate reference to the fact that the Receivables and

Contracts have been assigned to the Collateral Agent and that the Collateral

Agent has a security interest therein.

3.3 Direction to

Account Debtors; Contracting Parties; Etc.

Upon the occurrence of an Event of Default and if the

Collateral Agent so directs, the Assignor agrees (1) to cause all payments on

account of the Receivables and Contracts to be made directly to the Cash

Collateral Account and (2) that the Collateral Agent may, at its option,

directly notify the obligors with respect to any Receivables and/or under any

Contracts to make payments with respect thereto as provided in preceding clause

(1). Without notice to or assent by the Assignor, the Collateral Agent may

apply any or all amounts then in, or thereafter deposited in, the Cash

Collateral Account in the manner

provided in Section 7.4 of this Agreement. The costs and expenses (including,

without limitation, attorneys' fees) of collection, whether incurred by the

Assignor or the Collateral Agent, shall be borne by the Assignor.

3.4 Modification

of Terms; Etc.

The Assignor shall not rescind

or cancel any indebtedness evidenced by any Receivable or under any Contract,

or modify any term thereof or make any adjustment with respect thereto, or

extend or renew the same, or compromise or settle any dispute, claim, suit or

legal proceeding relating thereto, or sell any Receivable or Contract, or

interest therein, without the prior written consent of the Required Banks,

except as permitted by Section 3.5. The Assignor will duly fulfill all

obligations on its part to be fulfilled under or in connection with the

Receivables and Contracts and will do nothing to impair the rights of the

Collateral Agent in the Receivables or Contracts.

3.5 Collection

The Assignor shall endeavor to

cause to be collected from the account debtor named in each of its Receivables

or obligor under any Contract, as and when due (including, without limitation,

amounts which are delinquent, such amounts to be collected in accordance with

generally accepted lawful collection procedures) any and all amounts owing

under or on account of such Receivable or Contract, and apply forthwith upon

receipt thereof all such amounts as are so collected to the outstanding balance

of such Receivable or under such Contract, except that, prior to the occurrence

of an Event of Default, the Assignor may allow in the ordinary course of

business as adjustments to amounts owing under its Receivables and Contracts (a)

an extension or renewal of the time or times of payment, or settlement for less

than the total unpaid balance, which the Assignor finds appropriate in

accordance with sound business judgment and (b) a refund or credit due as a

result of returned or damaged merchandise or improperly performed services.

The costs and expenses (including, without limitation, attorneys' fees) of

collection, whether incurred by the Assignor or the Collateral Agent, shall be

borne by the Assignor.

3.6 Instruments

If the Assignor owns or acquires

any Instrument, the Assignor will within [spelled number of days] (______) days

notify the Collateral Agent thereof, and upon request by the Collateral Agent

promptly deliver such Instrument to the Collateral Agent appropriately endorsed

to the order of the Collateral Agent as further security hereunder.

3.7 Further

Actions

The Assignor will, at its own

expense, make, execute, endorse, acknowledge, file and/or deliver to the

Collateral Agent from time to time such vouchers, invoices, schedules,

confirmatory assignments, conveyances, financing statements, transfer

endorsements, powers of attorney, certificates, reports and other assurances or

instruments and take such further steps relating to its Receivables, Contracts,

Instruments and other property or rights covered by the security interest

hereby granted, as the Collateral Agent may reasonably require.

4. Special

Provisions Concerning Trademarks

4.1 Additional

Representations and Warranties

The Assignor represents and

warrants that it is the true and lawful exclusive owner of the Marks listed in

Annex ______ and that said listed Marks constitute all the marks registered in

the United States Patent and Trademark Office that the Assignor now owns or

uses in connection with its business. The Assignor represents and warrants

that it owns or is licensed to use all Marks that it uses. The Assignor

further warrants that it is aware of no third party claim that any aspect of

the Assignor's present or contemplated business operations infringes or will

infringe any Mark.

4.2 Licenses and

Assignments

The Assignor hereby agrees not

to divest itself of any right under a Mark absent prior written approval of the

Collateral Agent.

4.3 Infringements

The Assignor agrees, promptly

upon learning thereof, to notify the Collateral Agent in writing of the name

and address of, and to furnish such pertinent information that may be available

with respect to, any party who may be infringing or otherwise violating any of

the Assignor's rights in and to any significant Mark, or with respect to any

party claiming that the Assignor's use of any significant Mark violates any

property right of that party. The Assignor further agrees, unless otherwise

directed by the Collateral Agent, diligently to prosecute any Person infringing

any significant Mark.

4.4 Preservation

of Marks

The Assignor agrees to use its

significant Marks in interstate commerce during the time in which this

Agreement is in effect, sufficiently to preserve such Marks as trademarks or

service marks registered under the laws of the United States.

4.5 Maintenance

of Registration

The Assignor shall, at its own

expense, diligently process all documents required by the Trademark Act of

1946, 15 USCA §1051 et seq., to maintain trademark registration, including, but

not limited to, affidavits of use and applications for renewals of registration

in the United States Patent and Trademark Office for all of its Marks pursuant

to 15 USCA §§ 1058(a), 1059 and 1065, and shall pay all fees and disbursements

in connection therewith, and shall not abandon any such filing of affidavit of

use or any such application of renewal prior to the exhaustion of all

administrative and judicial remedies without prior written consent of the

Required Banks. The Assignor agrees to notify the Collateral Agent six months

prior to the dates on which the affidavits of use or the applications for

renewal registration are due that the affidavit of use or the renewal is being

processed.

4.6 Future

Registered Marks

If any mark registration issues

hereafter to the Assignor as a result of any application now or hereafter

pending before the United States Patent and Trademark Office, within [spelled

number of days] (______) days of receipt of such certificate the Assignor shall

deliver a copy of such certificate, and a grant of security in such mark, to

the Collateral Agent, confirming the grant thereof hereunder, the form of such

confirmatory grant to be substantially the same as the form hereof.

4.7 Remedies

If an Event of Default shall

occur and be continuing, the Collateral Agent may, by written notice to the

Assignor, take any or all of the following actions: (a) declare the entire

right, title and interest of the Assignor in and to each of the Marks, together

with all trademark rights and rights of protection to the same, vested, in

which event such rights, title and interest shall immediately vest, in the

Collateral Agent for the benefit of the Banks and the holders of the Notes, in

which case the Assignor agrees to execute an assignment in form and substance

satisfactory to the Collateral Agent of all its rights, title and interest in

and to the Marks to the Collateral Agent for the benefit of the Banks and the

holders of the Notes; (b) take and use or sell the Marks and the goodwill of

the Assignor's business symbolized by the Marks and the right to carry on the

business and use the assets of the Assignor in connection with which the Marks

have been used; and (c) direct the Assignor to refrain, in which event the Assignor

shall refrain, from using the Marks in any manner whatsoever, directly or

indirectly, and, if requested by the Collateral Agent, change the Assignor's

corporate name to eliminate therefrom any use of any Mark and execute such

other and further documents that the Collateral Agent may request to further

confirm this and to transfer ownership of the Marks and registrations and any

pending trademark application in the United States Patent and Trademark Office

to the Collateral Agent.

5. Special

Provisions Concerning Patents and Copyrights

5.1 Additional

Representations and Warranties

The Assignor represents and

warrants that it is the true and lawful exclusive owner of all rights in the

Patents listed in Annex ______ and in the Copyrights listed in Annex ______,

that said Patents constitute all the U.S. Patents and applications for U.S.

Patents that the Assignor now owns and that said Copyrights constitute all the

U.S. Copyrights that the Assignor now owns. The Assignor represents and

warrants that it owns or is licensed to use or practice under all Patents and

Copyrights that it now owns, uses or practices under. The Assignor further

warrants that it is aware of no third party claim that any aspect of the

Assignor's present or contemplated business operations infringes or will

infringe any Patent or any Copyright.

5.2 Licenses and

Assignments

The Assignor hereby agrees not

to divest itself of any right under a Patent or Copyright absent prior written

approval of the Collateral Agent.

5.3 Infringements

The Assignor agrees, promptly

upon learning thereof, to furnish the Collateral Agent in writing with all

pertinent information available to the Assignor with respect to any

infringement or other violation of the Assignor's rights in any significant

Patent or Copyright, or with respect to any claim that practice of any

significant Patent or Copyright violates any property right of that party. The

Assignor further agrees, absent direction of the Collateral Agent to the

contrary, diligently to prosecute any Person infringing any significant Patent

or Copyright.

5.4 Maintenance

of Patents

At its own expense, the Assignor

shall make timely payment of all post-issuance fees required pursuant to 35

USCA § 41 to maintain in force rights under each Patent.

5.5 Prosecution

of Patent Application

At its own expense, the Assignor

shall diligently prosecute all applications for U.S. Patents listed on Annex

______, and shall not abandon any such application prior to exhaustion of all

administrative and judicial remedies, absent written consent of the Collateral

Agent.

5.6 Other Patents

and Copyrights

Within [spelled number of days]

(______) days of acquisition of a US Patent or Copyright, or of filing of an

application for a US Patent or Copyright, the Assignor shall deliver to the

Collateral Agent a copy of said Patent or Copyright, as the case may be, with a

grant of security as to such Patent or Copyright, as the case may be,

confirming the grant thereof hereunder, the form of such confirmatory grant to

be substantially the same as the form hereof.

5.7 Remedies

If an Event of Default shall

occur and be continuing, the Collateral Agent may, by written notice to the

Assignor, take any or all of the following actions: (a) declare the entire

right, title and interest of the Assignor in each of the Patents and Copyrights

vested, in which event such right, title and interest shall immediately vest in

the Collateral Agent for the benefit of the Banks and the holders of the Notes,

in which case the Assignor agrees to execute an assignment in form and

substance satisfactory to the Collateral Agent of all its right, title and

interest to such Patents and Copyrights to the Collateral Agent for the benefit

of the Banks and the holders of the Notes; (b) take and practice or sell the

Patents and Copyrights; and (c) direct the Assignor to refrain, in which event

the Assignor shall refrain, from practicing the Patents and Copyrights directly

or indirectly, and the Assignor shall execute such other and further documents

as the Collateral Agent may request further to confirm this and to transfer

ownership of the Patents and Copyrights to the Collateral Agent.

6. Provisions

Concerning All Collateral

6.1 Protection of

Collateral Agent's Security

The Assignor will do nothing to

impair the rights of the Collateral Agent in the Collateral. The Assignor will

at all times keep its Inventory and Equipment insured in favor of the

Collateral Agent, at its own expense, to the Collateral Agent's reasonable

satisfaction against fire, theft and all other risks to which such Collateral

may be subject; all policies or certificates with respect to such insurance

shall be endorsed to the Collateral Agent's satisfaction for the benefit of the

Collateral Agent (including, without limitation, by naming the Collateral Agent

as loss payee) and deposited with the Collateral Agent. If the Assignor shall

fail to insure such Inventory and Equipment to the Collateral Agent's

reasonable satisfaction, or if the Assignor shall fail to so endorse and

deposit all policies or certificates with respect thereto, the Collateral Agent

shall have the right (but shall be under no obligation) to procure such

insurance and the Assignor agrees to reimburse the Collateral Agent for all

costs and expenses of procuring such insurance. The Collateral Agent may apply

any proceeds of such insurance when received by it toward the payment of any of

the Obligations to the extent the same shall then be due. The Assignor assumes

all liability and responsibility in connection with the Collateral acquired by

it and the liability of the Assignor to pay its Obligations shall in no way be

affected or diminished by reason of the fact that such Collateral may be lost,

destroyed, stolen, damaged or for any reason whatsoever unavailable to the Assignor.

6.2 Warehouse

Receipts Non-Negotiable

The Assignor agrees that if any

warehouse receipt or receipt in the nature of a warehouse receipt is issued

with respect to any of its Inventory, such warehouse receipt or receipt in the

nature thereof shall not be "negotiable" (as such term is used in

Section 7-104 of the Uniform Commercial Code as in effect in any relevant

jurisdiction or under other relevant law).

6.3 Further

Actions

The Assignor will, at its own

expense, make, execute, endorse, acknowledge, file and/or deliver to the

Collateral Agent from time to time, such lists, descriptions and designations

of its Collateral, warehouse receipts, receipts in the nature of warehouse

receipts, bills of lading, documents of title, vouchers, invoices, schedules,

confirmatory assignments, conveyances, financing statements, transfer

endorsements, powers of attorney, certificates, reports and other assurances or

instruments and take such further steps relating to the Collateral and other

property or rights covered by the security interest hereby granted, which the

Collateral Agent deems reasonably appropriate or advisable to perfect, preserve

or protect its security interest in the Collateral.

6.4 Financing

Statements

The Assignor agrees to assign and deliver to the Collateral

Agent such financing statements, in form acceptable to the Collateral Agent, as

the Collateral Agent may from time to time reasonably request or as are

necessary or desirable in the opinion of the Collateral Agent to establish and

maintain a valid, enforceable, first priority security interest in the

Collateral as provided herein and the other rights and security contemplated

herein, all in accordance with the Uniform Commercial Code as enacted in any

and all relevant jurisdictions or any other relevant

law. The Assignor will pay any

applicable filing fees and related expenses. The Assignor authorizes the

Collateral Agent to file any such financing statements without the signature of

the Assignor.

7. Remedies Upon

Occurrence of Event of Default

7.1 Remedies;

Obtaining Collateral Upon Default

The Assignor agrees that, if any

Event of Default shall have occurred and be continuing, then and in every such

case, subject to any mandatory requirements of applicable law then in effect,

the Collateral Agent, in addition to any rights now or hereafter existing under

applicable law, shall have all rights as a secured creditor under the Uniform

Commercial Code in all relevant jurisdictions and may:

(a) Personally,

or by agents or attorneys, immediately retake possession of the Collateral or

any part thereof, from the Assignor or any other Person who then has possession

of any part thereof with or without notice or process of law, and for that

purpose may enter upon the Assignor's premises where any of the Collateral is

located and remove the same and use in connection with such removal any and all

services, supplies, aids and other facilities of the Assignor;

(b) Instruct

the obligor or obligors on any agreement, instrument or other obligation

(including, without limitation, the Receivables) constituting the Collateral to

make any payment required by the terms of such instrument or agreement directly

to the Collateral Agent;

(c) Withdraw

all monies, securities and instruments in the Cash Collateral Account for

application to the Obligations;

(d) Sell,

assign or otherwise liquidate, or direct the Assignor to sell, assign or

otherwise liquidate, any or all of the Collateral or any part thereof, and take

possession of the proceeds of any such sale or liquidation; and

(e) Take

possession of the Collateral or any part thereof, by directing the Assignor in

writing to deliver the same to the Collateral Agent at any place or places

designated by the Collateral Agent, in which event the Assignor shall at its

own expense: (1) forthwith cause the same to be moved to the place or places

so designated by the Collateral Agent and there delivered to the Collateral

Agent, (2) store and keep any Collateral so delivered to the Collateral Agent

at such place or places pending further action by the Collateral Agent as

provided in Section 7.2, and (3) while the Collateral shall be so stored and

kept, provide such guards and maintenance services as shall be necessary to

protect the same and to preserve and maintain them in good condition; it being

understood that the Assignor's obligation so to deliver the Collateral is of

the essence of this Agreement and that, accordingly, upon application to a

court having jurisdiction, the Collateral Agent shall be entitled to a decree

requiring specific performance by the Assignor of said obligation.

7.2 Remedies;

Disposition of Collateral

Any Collateral repossessed by

the Collateral Agent under or pursuant to Section 7.1, and any other Collateral

whether or not so repossessed by the Collateral Agent, may be sold, assigned,

leased or otherwise disposed of under one or more contracts or as an entirety,

and without the necessity of gathering at the place of sale the property to be

sold, and in general in such manner, at such time or times, at such place or

places and on such terms as the Collateral Agent may, in compliance with any

mandatory requirements of applicable law, determine to be commercially

reasonable. Any of the Collateral may be sold, leased or otherwise disposed of,

in the condition in which the same existed when taken by the Collateral Agent

or after any overhaul or repair which the Collateral Agent shall determine to

be commercially reasonable. Any such disposition which shall be a private sale

or other private proceeding permitted by such requirements shall be made upon

not less than [spelled number of days] (______) days' written notice to the

Assignor specifying the time at which such disposition is to be made and the

intended sale price or other consideration therefor, and shall be subject, for

the [spelled number of days] (______) days after the giving of such notice, to

the right of the Assignor or any nominee of the Assignor to acquire the

Collateral involved at a price or for such other consideration at least equal

to the intended sale price or other consideration so specified. Any such

disposition which shall be a public sale permitted by such requirements shall

be made upon not less than [spelled number of days] (______) days' written

notice to the Assignor specifying the time and place of such sale and, in the

absence of applicable requirements of law, shall be by public auction (which

may, at the Collateral Agent's option, be subject to reserve), after

publication of notice of such auction not less than [spelled number of days]

(______) days prior thereto in two newspapers in general circulation in

______. To the extent permitted by any such requirement of law, the Collateral

Agent on behalf of the Banks and/or the holders of the Notes may bid for and become

the purchaser of the Collateral or any item thereof, offered for sale in

accordance with this Section 7.2 without accountability to the Assignor (except

to the extent of surplus money received as provided in Section 7.4). If, under

mandatory requirements of applicable law, the Collateral Agent shall be

required to make disposition of the Collateral within a period of time which

does not permit the giving of notice to the Assignor as hereinabove specified,

the Collateral Agent need give the Assignor only such notice of disposition as

shall be reasonably practicable in view of such mandatory requirements of

applicable law.

7.3 Waiver of

Claims

Except as otherwise provided in

this Agreement, THE ASSIGNOR HEREBY WAIVES, TO THE EXTENT PERMITTED BY

APPLICABLE LAW, NOTICE AND JUDICIAL HEARING IN CONNECTION WITH THE COLLATERAL

AGENT'S TAKING POSSESSION OR THE COLLATERAL AGENT'S DISPOSITION OF ANY OF THE

COLLATERAL, INCLUDING, WITHOUT LIMITATION, ANY AND ALL PRIOR NOTICE AND HEARING

FOR ANY PREJUDGMENT REMEDY OR REMEDIES AND ANY SUCH RIGHT WHICH ASSIGNOR WOULD

OTHERWISE HAVE UNDER THE CONSTITUTION OR ANY STATUTE OF THE UNITED STATES OR OF

ANY STATE, and the Assignor hereby further waives, to the extent permitted by

law:

(a) All

damages occasioned by such taking of possession except any damages which are

the direct result of the Collateral Agent's gross negligence or willful

misconduct;

(b) All

other requirements as to the time, place and terms of sale or other

requirements with respect to the enforcement of the Collateral Agent's rights

hereunder; and

(c) All

rights of redemption, appraisement, valuation, stay, extension or moratorium

now or hereafter in force under any applicable law in order to prevent or delay

the enforcement of this Agreement or the absolute sale of the Collateral or any

portion thereof, and the Assignor, for itself and all who may claim under it,

insofar as it or they now or hereafter lawfully may, hereby waives the benefit

of all such laws.

Any sale of, or the grant of

options to purchase, or any other realization upon, any Collateral shall

operate to divest all right, title, interest, claim and demand, either at law

or in equity, of the Assignor therein and thereto, and shall be a perpetual bar

both at law and in equity against the Assignor and against any and all Persons

claiming or attempting to claim the Collateral so sold, optioned or realized

upon, or any part thereof, from, through and under the Assignor.

7.4 Application

of Proceeds

The proceeds of any Collateral

obtained pursuant to Section 7.1 or disposed of pursuant to Section 7.2 shall

be applied as follows:

(a) To

the payment of any and all expenses and fees (including, without limitation,

reasonable attorneys' fees) incurred by the Collateral Agent in obtaining,

taking possession of, removing, insuring, repairing, storing and disposing of

Collateral and any and all amounts incurred by the Collateral Agent in

connection therewith;

(b) Next,

any surplus then remaining to the payment of the Obligations in the following

order of priority: (1) all interest accrued and unpaid; (2) the principal

amount owing on the Loans; (3) the fees than owing to the Agent; and (4) all

other Obligations then owing; and

(c) If

the Total Commitment is then terminated and no other Obligation is outstanding,

any surplus then remaining shall be paid to the Assignor, subject, however, to the

rights of the holder of any then existing Lien of which the Collateral Agent

has actual notice (without investigation); it being understood that the

Assignor shall remain liable to the extent of any deficiency between the amount

of the proceeds of the Collateral and the aggregate amount of the sums referred

to in clauses (a) and (b) of this Section 7.4 with respect to the Assignor.

7.5 Remedies Cumulative

No failure or delay on the part of the Collateral Agent or

any Bank or any holder of any Note in exercising any right, power or privilege

hereunder or under any other Credit Document and no

course of dealing between the

Assignor and the Collateral Agent or any Bank or the holder of any Note shall

operate as a waiver thereof; nor shall any single or partial exercise of any

right, power or privilege hereunder or under any other Credit Document preclude

any other or further exercise thereof or the exercise of any other right, power

or privilege hereunder or thereunder. The rights, powers and remedies herein

or in any other Credit Document expressly provided are cumulative and not

exclusive of any rights, powers or remedies which the Collateral Agent or any

Bank or the holder of any Note would otherwise have. No notice to or demand on

the Assignor in any case shall entitle the Assignor to any other or further

notice or demand in similar or other circumstances or constitute a waiver of

the rights of the Collateral Agent or any Bank or the holder of any Note to any

other or further action in any circumstances without notice or demand.

7.6 Discontinuance

of Proceedings

In case the Collateral Agent

shall have instituted any proceeding to enforce any right, power or remedy

under this Agreement by foreclosure, sale, entry or otherwise, and such

proceeding shall have been discontinued or abandoned for any reason or shall

have been determined adversely to the Collateral Agent, then and in every such

case the Assignor, the Collateral Agent and each holder of any of the

Obligations shall be restored to their former positions and rights hereunder

with respect to the Collateral subject to the security interest created under

this Agreement, and all rights, remedies and powers of the Collateral Agent

shall continue as if no such proceeding had been instituted.

8. Indemnity

8.1 Indemnity

(a) The Assignor agrees to indemnify, reimburse and

hold the Collateral Agent, each Bank, the holder of any Note, and their

respective officers, directors, employees, representatives and agents

(hereinafter in this Section 8.1 referred to individually as

"Indemnitee" and collectively as "Indemnitees") harmless

from any and all liabilities, obligations, losses, damages, penalties, claims,

actions, judgments, suits, costs, expenses or disbursements (including, without

limitation, reasonable attorneys' fees and expenses) (for the purposes of this

Section 8.1 the foregoing are collectively called "expenses") of

whatsoever kind or nature which may be imposed on, asserted against or incurred

by any of the Indemnitees in any way relating to or arising out of this

Agreement, any other Credit Document or the documents executed in connection

herewith and therewith or in any other way connected with the administration of

the transactions contemplated hereby and thereby or the enforcement of any of

the terms of or the preservation of any rights under any thereof, or in any way

relating to or arising out of the manufacture, ownership, ordering, purchase,

delivery, control, acceptance, lease, financing, possession, operation,

condition, sale, return or other disposition or use of the Collateral

(including, without limitation, latent or other defects, whether or not

discoverable), the violation of the laws of any country, state or other

governmental body or unit, any tort (including, without limitation, claims

arising or imposed under the doctrine of strict liability, or for or on account

of injury to or the death of any Person (including any Indemnitee), or for

property

damage) or any contract claim; provided, however, that no Indemnitee shall be

indemnified pursuant to this Section 8.1(a) for expenses to the extent caused

by the gross negligence or willful misconduct of such Indemnitee. The Assignor

agrees that upon written notice by any Indemnitee of any assertion that could

give rise to an expense, the Assignor shall assume full responsibility for the

defense thereof. Each Indemnitee agrees to use its best efforts to promptly

notify the Assignor of any such assertion of which such Indemnitee has

knowledge.

(b) Without

limiting the application of Section 8.1(a), the Assignor agrees to pay, or

reimburse the Collateral Agent for (if the Collateral Agent shall have incurred

fees, costs or expenses because the Assignor shall have failed to comply with

its obligations under this Agreement or any other Credit Document), any and all

fees, costs and expenses of whatever kind or nature incurred in connection with

the creation, preservation or protection of the Collateral Agent's Liens on,

and security interest in, the Collateral, including, without limitation, all

fees and taxes in connection with the recording or filing of instruments and

documents in public offices, payment or discharge of any taxes or Liens upon or

in respect of the Collateral, premiums for insurance with respect to the

Collateral and all other fees, costs and expenses in connection with

protecting, maintaining or preserving the Collateral and the Collateral Agent's

interest therein, whether through judicial proceedings or otherwise, or in

defending or prosecuting any actions, suits or proceedings arising out of or

relating to the Collateral.

(c) Without

limiting the application of Section 8.1(a) or (b), the Assignor agrees to pay,

indemnify and hold each Indemnitee harmless from and against any expenses which

such Indemnitee may suffer, expend or incur in consequence of or growing out of

any misrepresentation by the Assignor in this Agreement or any of the other

Credit Documents or in any statement or writing contemplated by or made or

delivered pursuant to or in connection with this Agreement or any of the other

Credit Documents.

(d) If

and to the extent that the obligations of the Assignor under this Section 8.1

are unenforceable for any reason, Assignor hereby agrees to make the maximum

contribution to the payment and satisfaction of such obligations which is

permissible under applicable law.

8.2 Indemnity

Obligations Secured by Collateral; Survival

Any amounts paid by any

Indemnitee as to which such Indemnitee has the right to reimbursement shall

constitute Obligations secured by the Collateral. The indemnity obligations of

the Assignor contained in this Section 8 shall continue in full force and

effect notwithstanding the full payment of all the Notes issued under the

Credit Agreement and all of the other Obligations and notwithstanding the

discharge thereof.

9. Definitions

The following terms shall have the meanings herein specified

unless the context otherwise requires. Such definitions shall be equally

applicable to the singular and plural forms of the

terms defined:

"Agreement"

shall mean this Security Agreement, as modified, supplemented or amended from

time to time.

"Assignor"

shall have the meaning provided in the first paragraph of this Agreement.

"Cash

Collateral Account" shall mean a restricted non-interest bearing cash collateral

account maintained with the Collateral Agent for the benefit of the Banks.

"Chattel

Paper" shall have the meaning assigned that term under the Uniform

Commercial Code as in effect on the date hereof in the State of ______.

"Collateral"

shall have the meaning provided in Section 1.1(a).

"Collateral

Agent" shall have the meaning provided in the first paragraph of this

Agreement.

"Contracts"

shall mean all contracts between the Assignor and one or more additional

parties and all rights of the Assignor (including, without limitation, all

rights to payment) under each such contract.

"Copyrights"

shall mean any US copyright to which the Assignor now or hereafter has title,

as well as any application for a US copyright hereafter made by the Assignor.

"Credit

Agreement" shall have the meaning provided in the first paragraph of this

Agreement.

"Documents"

shall have the meaning assigned that term under the Uniform Commercial Code as

in effect on the date hereof in the State of ______.

"Equipment"

shall mean any "equipment", as such term is defined in the Uniform

Commercial Code as in effect on the date hereof in the State of ______, now or

hereafter owned by Assignor and, in any event, shall include, but shall not be

limited to, all machinery, equipment, furnishings, fixtures and vehicles now or

hereafter owned by the Assignor and any and all additions, substitutions and

replacements of, any of the foregoing, wherever located, together with all

attachments, components, parts, equipment and accessories installed thereon or

affixed thereto.

"General

Intangibles" shall have the meaning assigned that term under the Uniform

Commercial Code as in effect on the date hereof in the State of ______.

"Goods"

shall have the meaning assigned that term under the Uniform Commercial Code as

in effect on the date hereof in the State of ______.

"Indemnitee"

shall have the meaning specified in Section 8.1.

"Instrument"

shall have the meaning assigned that term under the Uniform Commercial Code as

in effect on the date hereof in the State of ______.

"Inventory"

shall mean all raw materials, work-in-process, and finished inventory of the

Assignor of every type or description and all documents of title covering such

inventory, and shall specifically include all "inventory" as such

term is defined in the Uniform Commercial Code as in effect on the date hereof

in the State of ______, now or hereafter owned by the Assignor.

"Marks"

shall mean any trademarks and service marks now held or hereafter acquired by

the Assignor, which are registered in the United States Patent and Trademark

Office, as well as any unregistered marks used by the Assignor in the United

States and trade dress, including logos and/or designs, in connection with

which any of these registered or unregistered marks are used.

"Obligations"

shall mean: (1) all indebtedness, obligations and liabilities (including,

without limitation, guarantees and other contingent liabilities) of the

Assignor to the Collateral Agent, the Agent, any Bank or the holder of any Note

arising under or in connection with any Credit Document; (2) any and all sums

advanced by the Collateral Agent in order to preserve the Collateral or

preserve its security interest in the Collateral; and (3) in the event of any

proceeding for the collection or enforcement of any indebtedness, obligations

or liabilities of the Assignor referred to in clause (1), after an Event of

Default shall have occurred and be continuing, the reasonable expenses of

re-taking, holding, preparing for sale or lease, selling or otherwise disposing

or realizing on the Collateral, or of any exercise by the Collateral Agent of

its rights hereunder, together with reasonable attorneys' fees and court costs.

"Patents"

shall mean any U.S. Patent to which the Assignor now or hereafter has title, as

well as any application for a U.S. Patent now or hereafter made by Assignor.

"Proceeds"

shall have the meaning assigned that term under the Uniform Commercial Code as

in effect in the State of ______ on the date hereof or under other relevant law

and, in any event, shall include, but not be limited to, (1) any and all

proceeds of any insurance, indemnity, warranty or guaranty payable to the

Collateral Agent or the Assignor from time to time with respect to any of the

Collateral, (2) any and all payments (in any form whatsoever) made or due and

payable to the Assignor from time to time in connection with any requisition,

confiscation, condemnation, seizure or forfeiture of all or any part of the

Collateral by any governmental authority (or any Person acting under color of

governmental authority) and (3) any and all other amounts from time to time

paid or payable under or in connection with any of the Collateral.

"Receivables" shall mean any "account"

as such term is defined in the Uniform Commercial Code as in effect on the date

hereof in the State of ______, now or hereafter owned by Assignor and, in any

event, shall include, but shall not be limited to, all of the Assignor's rights

to payment for goods sold or leased or services performed by the

Assignor,

whether now in existence or arising from time to time hereafter, including,

without limitation, rights evidenced by an account, note, contract, security

agreement, chattel paper or other evidence of indebtedness or security,

together with (1) all security pledged, assigned, hypothecated or granted to or

held by the Assignor to secure the foregoing; (2) all of the Assignor's right,

title and interest in and to any goods, the sale of which gave rise thereto;

(3) all guarantees, endorsements and indemnifications on, or of, any of the

foregoing; (4) all powers of attorney for the execution of any evidence of

indebtedness or security or other writing in connection therewith; (5) all

books, records, ledger cards and invoices relating thereto; (6) all evidences

of the filing of financing statements and other statements and the registration

of other instruments in connection therewith and amendments thereto, notices to

other creditors or secured parties, and certificates from filing or other

registration officers; (7) all credit information, reports and memoranda

relating thereto and (8) all other writings related in any way to the

foregoing.

10. Miscellaneous

10.1 Notices

Any notice or other

communication under this Agreement shall be in writing, and any written notice

or other document shall be deemed to have been duly given (a) on the date of

personal service on the parties, (b) on the third business day after mailing,

if the document is mailed by registered or certified mail, (c) one day after

being sent by professional or overnight courier or messenger service

guaranteeing one-day delivery, with receipt confirmed by the courier, or (d) on

the date of transmission if sent by telegram, telex, telecopy, or other means

of electronic transmission resulting in written copies, with receipt

confirmed. Any such notice shall be delivered or addressed to the parties at

the address set forth below or at the most recent address specified by the

addressee through written notice under this provision. Failure to conform to

the requirement that mailings be done by registered or certified mail shall not

defeat the effectiveness of notice actually received by the addressee.

10.2 Waiver;

Amendment

This Agreement may be changed,

waived, discharged, or terminated only by an instrument in writing signed by

the party against which enforcement of such change, waiver, discharge or

termination is sought. Without limiting the generality of the preceding

sentence, this Agreement may not be modified by oral agreement even if such

modification is supported by new consideration.

10.3 Obligations

The obligations of the Assignor under this Agreement shall

be absolute and unconditional and shall remain in full force and effect without

regard to, and shall not be released, suspended, discharged, terminated or

otherwise affected by, any circumstance or occurrence whatsoever, including,

without limitation: (a) any renewal, extension, amendment or modification of,

or addition or supplement to or deletion from, any of the Credit Documents or

any other instrument or agreement referred to therein, or any assignment or

transfer of any thereof; (b) any waiver,

consent, extension, indulgence

or other action or inaction under or in respect of any such instrument or agreement

or this Agreement or any exercise or non-exercise of any right, remedy, power

or privilege under or in respect of this Agreement or any other Credit

Document; (c) any furnishing of any additional security to the Collateral Agent

or any acceptance thereof or any sale, exchange, release, surrender or

realization of or upon any security by the Collateral Agent or (d) any

invalidity, irregularity or unenforceability of all or part of the Obligations

or of any security therefor.

10.4 Successors and

Assigns

This Agreement shall be binding

upon and inure to the benefit of and be enforceable by the respective

successors and assigns of the parties hereto; provided, however, that the

Assignor may not assign or transfer any of its rights or obligations hereunder

without the prior written consent of the Collateral Agent. All agreements,

statements, representations and warranties made by the Assignor herein or in

any certificate or other instrument delivered by the Assignor or on its behalf

under this Agreement shall be considered to have been relied upon by the Banks

and shall survive the execution and delivery of this Agreement and the other

Credit Documents regardless of any investigation made by the Banks or on their

behalf.

10.5 Headings

The headings of the several

sections and subsections of this Agreement are inserted for convenience only

and shall not in any way affect the meaning or construction of any provision of

this Agreement.

10.6 Governing Law

This Agreement and the rights

and obligations of the parties hereunder shall be construed in accordance with

and be governed by the law of the State of ______.

10.7 Assignor's

Duties

It is expressly agreed, anything

herein contained to the contrary notwithstanding, that the Assignor shall

remain liable to perform all of the obligations, if any, assumed by it with

respect to the Collateral and the Collateral Agent shall not have any

obligations or liabilities with respect to any Collateral by reason of or

arising out of this Agreement, nor shall the Collateral Agent be required or

obligated in any manner to perform or fulfill any of the obligations of the

Assignor under or with respect to any Collateral.

10.8 Termination;

Release

After the termination of the Total Commitment, and when all

Obligations have been paid in full, this Agreement shall terminate, and the

Collateral Agent, at the request and expense of the Assignor, will execute and

deliver to the Assignor the appropriate instruments (including Uniform

Commercial Code termination statements on form UCC-3) acknowledging the

termination of this Agreement, and will duly assign, transfer and deliver to

the Assignor (without

recourse and without any

representation or warranty) such of the Collateral as may be in possession of

the Collateral Agent and has not theretofore been sold or otherwise applied or

released pursuant to this Agreement.

10.9 Counterparts

This Agreement may be executed

in any number of counterparts and by the different parties hereto on separate

counterparts, each of which when so executed and delivered shall be an

original, but all of which shall together constitute one and the same

instrument.

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be executed and delivered by their duly

authorized officers as of the date first above written.

ASSIGNOR:

[Sig Block Party 1]

______

______, ______ ______

[Notary Party 1]

COLLATERAL AGENT:

[Sig Block Party 2]

______

______, ______ ______

[Notary Party 2]

Attorney Advertising

Fernandes Law Firm

is only advertising in states where they are admitted to practice

|

Contributed by

JP |

|

|

Name of Firm |

Fernandes Law Firm |

|

Profession |

Lawyer

Lawyer |

|

Number of lawyers in firm |

1 |

|

Branch of Law |

Corporate, Contract, Commercial, Shareholder Disputed, |

|

Location |

Milwaukee,

Wisconsin,

United States |

|

Principal Office Address |

500 W Silver Spring Dr. K-200

Milwaukee, WI 53217. |

|

Practicing law since |

5/27/1997 |

|

Total Forms Contributed |

6 |

|

Phone |

414-915-6599 |

|

Website |

www.businesslawyerofmilwaukee.com |

|

J.P. Fernandes, Esq. is an informed experienced transactional and commercial attorney who counsels businesses on an array of organizational questions and planning matters. These include shareholder, contract, finance, and private placements, as well as issues related to the sale and purchases of businesses. J.P. Fernandes is licensed by the State of Wisconsin and Federal Bars and admitted to practice in the Federal District Court, Eastern District of Wisconsin, the Wisconsin Supreme Court, and the Court of International Trade, (Customs Court Located in New York, New York). |

See All

JP's Forms |

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

Keywords: security Agreement, UCC-1, lien, perfection,

|

|

|