|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

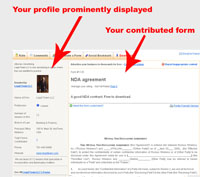

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

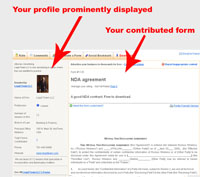

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

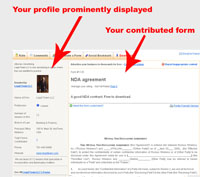

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #1522Stock option plan for officers of corporation and key employees

|

Average user rating: |

Not Yet Rated

|

Rate it |

|

Stock option plan for officers of corporation and key employees

this form has not been reviewed by a lawyer

|

Stock option plan for

officers of corporation and key employees.

Section 1. Establishment. There is established a stock

option plan (called the "plan") pursuant to which officers and key

employees of the corporation and its subsidiaries who are mainly responsible

for its continued growth and development and future financial success may be

granted options to purchase shares of common stock of the corporation, in order

to secure to the corporation the advantages of the incentive and sense of

proprietorship inherent in stock ownership by these persons.

Section 2. Administration. The plan shall be

administered by a committee (called "committee") of not less than

three directors of the corporation, none of whom shall be eligible to

participate in the plan, who shall be appointed and serve at the pleasure of

the board of directors. A majority of the committee shall constitute a quorum,

and the acts of a majority of the members present at any meeting at which a

quorum is present, or acts approved in writing by a majority of the committee,

shall be deemed the acts of the committee. Subject to the provisions of the

plan and to policies determined by the board of directors, the committee is

authorized to adopt rules and regulations and to take any action in the

administration of the plan as it shall deem proper.

Section 3. Eligibility. Officers and key employees of

the corporation and its subsidiaries (including officers and employees who are

directors of the corporation) who, in the opinion of the committee, are mainly

responsible for the continued growth and development and future financial

success of the business shall be eligible to participate in the plan. The

committee shall, in its sole discretion, from time to time, select from these

eligible persons those to whom options shall be granted and determine the

number of shares to be included in the option. No officer or employee shall

have any right to receive an option, except as he or she is selected by the

committee.

Section 4. Shares Subject to Plan. Options may be

granted pursuant to the plan to purchase up to 125,000 shares of common stock

(subject to adjustment as provided in section 6 of this article), which may be

authorized and unissued shares or shares held in the treasury of the

corporation. To the extent that options granted under the plan shall expire or

terminate without being exercised, shares covered shall remain available for

purposes of the plan.

Section 5. Terms of Options. Each option granted under

the plan shall be evidenced by a stock option agreement between the corporation

and the person to whom the option is granted and shall be subject to the

following terms and conditions:

(a). The price at which each share covered by an

option may be purchased shall be determined in each case by the committee but

shall be not less than 95 percent of the fair market value at the time the

option is granted.

(b). The aggregate number of shares covered by any

option or options to one individual shall not exceed 10 percent of the

aggregate number of shares subject to the plan as provided in section 4 of this

article, excluding in the computation of the percentage for any individual the

number of shares covered by any option previously granted to the extent that

the option shall have expired or terminated without being exercised.

(c). During the lifetime of the optionee, the option

may be exercised only by him or her. The option shall not be transferable by

the optionee other than by will or by the laws of descent and distribution.

After the death of the optionee, the option shall be transferable to the

corporation for cancellation, but only upon the terms and conditions, if any,

as the board of directors may determine.

(d). An option may be exercised in whole at any time,

or in part from time to time, within the period or periods not to exceed 10

years from the granting of the option as may be determined by the committee and

set forth in the stock option agreement (period or periods referred to as the

option period) provided that,

(i). if the optionee shall cease to be employed by the

corporation or any of its subsidiaries, the option may be exercised only within

3 months after the termination of employment and within the option period;

(ii). if the optionee shall die, the option may be

exercised only within 15 months after death and within the option period and

only by his or her personal representatives or persons entitled under the will

or the laws of descent and distribution; and

(iii). the option may not be exercised for more shares

(subject to adjustment as provided in section 6 of this article) after the

termination of the optionee's employment or death than the optionee was

entitled to purchase at the time of the termination of employment or death.

(e). The option price of each share purchased pursuant

to an option shall be paid in full in cash at the time of the exercise of the

option. Except in case of the exercise of an option by an executor or

administrator in connection with the administration of the estate of the

optionee, the person exercising the option shall certify at the time of the

exercise that he or she is acquiring the shares being purchased for investment

and not with any intention to resell or distribute them.

(f). In consideration for the granting of each option,

the optionee shall agree to remain in the employment of the corporation or one

of its subsidiaries, at the pleasure of the corporation or subsidiary, for at

least two years from the date of the granting of the option or until the

January first nearest his or her 65th birthday, whichever may be earlier, at

the salary rate in effect at the time of the granting of the option or at a

changed rate as may be fixed from time to time by the corporation or

subsidiary. At the discretion of the committee, this requirement may be waived

in the case of any optionee who during the two-year period enters the active

service of the military forces of the United States or other United States

government service connected with national defense activities. Nothing

contained in the plan nor in any stock option agreement shall confer upon any

optionee any right with respect to the continuance of employment by the

corporation or any of its subsidiaries nor interfere in any way with the right

of the corporation or any subsidiary to terminate employment or change

compensation at any time.

(g). Any other terms and conditions not inconsistent

with the foregoing as the committee shall approve.

Section 6. Adjustment of Number and Price of Shares.

(a). In the event that a dividend is declared upon the

common stock of the corporation payable in shares of stock, the number of

shares of common stock covered by each outstanding option and the number of

shares available for issuance pursuant to the plan but not yet covered by an

option shall be adjusted by adding the number of shares which would have been

distributable if the shares had been outstanding on the date fixed for

determining the shareholders entitled to receive the stock dividend.

(b). In the event that the outstanding shares of

common stock of the corporation are changed into or exchanged for a different

number or kind of shares of stock or other securities of the corporation or of

another corporation, whether through reorganization, recapitalization, stock

split-up, combination of shares, merger or consolidation, then there shall be

substituted for the shares of common stock covered by each outstanding option

and for the shares available for issuance pursuant to the plan but not yet

covered by an option, the number and kind of shares of stock or other

securities which would have been substituted if the shares had been outstanding

on the date fixed for determining the shareholders entitled to receive the

changed or substituted stock or other securities.

(c). In the event there is any change, other than

specified above in this section 6, in the number or kind of outstanding shares

of common stock of the corporation or of any stock or other securities into

which the common stock shall be changed or for which it shall have been

exchanged, then if the board of directors shall determine, in its discretion,

that the change equitably requires an adjustment in the number or kind of

shares covered by outstanding options or which are available for issuance

pursuant to the plan but not yet covered by an option. The adjustment shall be

made by the board of directors and shall be effective and binding for all

purposes of the plan and on each outstanding stock option agreement.

(d). No adjustment or substitution provided for in

this section 6 shall require the corporation to issue or to sell a fractional

share under any stock option agreement and the total adjustment or substitution

with respect to each stock option agreement shall be limited accordingly.

(e). In the case of any adjustment or substitution

provided for in this section 6, the option price per share in each stock option

agreement shall be equitably adjusted by the board of directors to reflect the

greater or lesser number of shares of stock or other securities into which the

stock covered by the option may have been changed.

Section 7. Sales of Stock. Upon authorization by the

board of directors and subject to the limitations as to amount set forth in

section 4 and paragraph (b) of section 5 of this article, the committee may,

from time to time, sell for cash common stock of the corporation to eligible

officers and employees, instead of granting options to them, upon terms as the

committee may determine. The selling price of the shares sold shall be

determined in each case by the committee but shall be not less than 95 percent

of the fair market value at the time of the sale. The purchaser shall certify

that he or she is acquiring the shares being purchased for investment and not

with an intention to resell or distribute them.

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

Keywords: Stock option plan, officers of corporation, key employees

|

|

|