|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

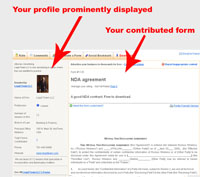

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #1245Agreement between shareholders and corporation to purchase stock (Section 303 redemption).

|

Average user rating: |

Not Yet Rated

|

Rate it |

|

Agreement between shareholders and corporation to purchase stock (Section 303 redemption).

this form has not been reviewed by a lawyer

|

Agreement between

shareholders and corporation to purchase stock (Section 303 redemption).

This is an agreement executed on _________[date],

between _________, Inc., an _________ corporation, called "the

Corporation," and _________, _________ and _________, sometimes referred

to collectively as "the shareholders," and each singly as "a

shareholder."

Witnesseth:

The shareholders own the common stock (referred to as

"shares") of the Corporation as follows:

|

.........................................................................................................

|

_________ shares

|

|

.........................................................................................................

|

_________ shares

|

|

.........................................................................................................

|

_________ shares

|

and they and the Corporation desire the

stock to remain closely held in order to promote harmonious management of the

Corporation's affairs.

Therefore, the shareholders and the Corporation agree

as follows:

1. Purchase obligations upon death.

1.1. Upon the death of a shareholder, his or her

estate shall sell and the Corporation and the surviving shareholders shall

purchase the shares which the deceased shareholder owned at death for the price

and upon the other terms provided.

1.2. The number of the deceased shareholder's shares

which the Corporation shall purchase shall be the lesser of:

(i). the maximum number which it may purchase and the

purchase qualify as a distribution in full payment in exchange for the estate's

stock under IRC §303, or under the equivalent section or sections of any

successor code in force at the shareholder's death. Provided that if: in the

opinion of counsel for the Corporation, the maximum number of shares that may

be purchased under this paragraph 1.2(i) is limited due to the operation of the

attribution rules of IRC §318, the Corporation shall purchase the shares held

by a deceased shareholder's spouse and lineal descendants.

(ii). the maximum which it may purchase under the laws

of the state or states having jurisdiction over the redemption of its stock;

and the surviving shareholders shall purchase the balance of the shares which

the deceased shareholder owned at his or her death.

1.3. Each surviving shareholder shall purchase and the

deceased shareholder's estate shall sell that portion of the balance of the

shares which the deceased shareholder owned at his or her death which equals

the proportion which the number of shares then owned by each such surviving

shareholder is of the total number of the shares then owned by all surviving

shareholders.

1.4. The parties recognize that the maximum number of

shares which the Corporation may purchase from the estate of a deceased

shareholder and the purchase qualify as a distribution in full payment and

exchange for the estate's stock under IRC §§ Section 303, is not exactly

determinable until the final determination of the amount of federal estate tax

and state death taxes of the deceased shareholder's estate, and that the latter

events which might not occur for a substantial time following the deceased

shareholder's death. Therefore, in order to provide for a timely redemption of

shares, the parties agree that the "maximum number" of shares which

the Corporation shall purchase for the purposes of paragraph 1.2(i), shall be

an estimate of the maximum number.

1.5. Within 30 days of appointment, the personal

representative of the deceased shareholder's estate shall file with the

Corporation this estimate in writing. There shall be set forth in the estimate

all facts by which its accuracy may be verified including a detailed

description of each asset includable in the gross estate of the deceased for

federal estate and state death tax purposes, together with the personal

representative's opinion as to the estate and state death tax value as of date

of death, an itemization of each deduction allowable in the personal

representative's opinion as a deduction from the gross estate in arriving at

the net estate subject to tax, funeral expenses and expenses of estate administration

and an enumeration of all credits allowable against federal estate tax and

state death taxes and calculations of the amount.

2. Option upon voluntary transfer.

2.1. Notice of transfer. If a shareholder intends to

transfer shares to any person other than the spouse or a lineal descendant of

the shareholder or to the Corporation, he or she shall give _________ days

written notice to the Corporation and the remaining shareholder of the

intention to transfer. The notice, in addition to stating the fact of the

intention to transfer shares, shall state (i) the number of shares to be

transferred, (ii) the name, business and residence address of the proposed

transferee, (iii) whether or not the transfer is for a valuable consideration,

and, if so, the amount of the consideration and the other terms of the sale.

2.2. First option to purchase. Within _________ days

of the Corporation's receipt of the notice, the Corporation may exercise an

option to purchase all or any portion of the shares proposed to be transferred

for the price and upon the other terms provided. If the Corporation does not

exercise its option to purchase all or any portion of the shares, each

remaining shareholder within _________ days of the Corporation's receipt of the

notice of the proposed transfer, may exercise an option to purchase that

proportion of unpurchased shares, which equals the proportion which the number

of the shares owned by each remaining shareholder at the time of the

Corporation's receipt of notice is of the total number of the shares then owned

by all remaining shares. The purchase option granted in this paragraph is

sometimes referred to as the "First Option."

2.3. Second option to purchase. If neither the

Corporation nor a shareholder exercises its or his or her First Option to

purchase shares, each remaining shareholder who is granted and who exercises a

First Option may within ten days after the expiration of the _________-day

option period provided for in paragraph 2.2 exercise an option to purchase the

shares with respect to which the Corporation or shareholder has failed to

exercise the First Option (the "option shares"). In the case of a

single remaining shareholder the option shall be to purchase all of the option

shares. In the case of two or more remaining shareholders, each remaining

shareholder's option shall be to purchase the number of option shares which

bears the same proportion to the total number of the option shares as the

number of shares owned by each remaining shareholder at the time of the Corporation's

receipt of the notice provided for in paragraph 2.2 bears to the total number

of shares then owned by all remaining shareholders, provided that all remaining

shareholders may by agreement among themselves determine the proportions in

which some or all of their number may exercise the option granted in this

paragraph 2.2. The purchase option granted by this paragraph is sometimes

referred to as the "Second Option."

2.4. The Corporation and the remaining shareholders

must in the aggregate exercise their options to purchase all of the shares

proposed to be transferred or forfeit their options.

2.5. If a shareholder who proposes to transfer shares

dies prior to the closing of the sale and purchase contemplated by this

paragraph 2, the shares shall be the subject of sale and purchase under

paragraph 1.

3. Option upon involuntary transfer. If other than by

reason of a shareholder's death shares are transferred by operation of law to

any person other than the Corporation (such as but not limited to a shareholder's

trustee in bankruptcy, a purchaser at any creditor's or court sale or the

guardian or conservator of an incompetent shareholder), the Corporation of the

remaining shareholders, within _________ days of the Corporation's receipt of

actual notice of the transfer in the case of a First Option and within

_________ days of that event in the case of a Second Option may exercise an

option to purchase all but not less than all of the shares so transferred in

the same manner and upon the same terms as provided in paragraph 2, with

respect to shares proposed to be transferred.

4. Exercise of options and effect of nonexercise of

options.

4.1. The Corporation and the shareholders who exercise

the First Option or Second Option granted in paragraph 1, 2 or 3 shall do so by

delivering written notice of their exercise of the options within the times

provided in those paragraphs to the personal representatives of a deceased

shareholder's estate in the case of paragraph 1 option, or to the proposed

transferor in case of a paragraph 2 option, or to the transferee in the case of

a paragraph 3 option, and to the remaining shareholders in either case.

4.2. If the purchase options are forfeited or not

exercised in compliance with paragraph 1, 2 or 3, then in the case of a proposed

transfer under paragraph 2, the shares may be transferred within ten days after

the expiration of the _________-day Second Option period granted to each

remaining shareholder under paragraph 2, and upon the terms stated, free of the

terms of this agreement; and in the case of shares owned by the estate of a

deceased shareholder as contemplated in paragraph 1, or a transfer of shares

under paragraph 3, the shares, after the expiration of the _________-day Second

Option period granted to each remaining shareholder under paragraph 1 or 3,

shall in the hands of the estate or transferee, be free of the terms of this

agreement.

4.3. If in the case of a paragraph 2 transfer, the

transfer is not upon the terms or is not to the transferee stated in the notice

required of the transferring shareholder by paragraph 2, or is not within the

_________-day period, or the transferor, after the transfer, reacquires all or

any portion of the transferred shares, the shares transferred shall remain

subject to this agreement as if no transfer had been made.

4.4. The personal representative of a deceased

shareholder's estate in the situation contemplated by paragraph 1, a proposed

transferor of shares under paragraph 2 or a transferee of shares under

paragraph 3, either, or both, as a shareholder or director of the Corporation,

shall vote in favor of the Corporation's exercise of the purchase options

granted to it by this agreement at any meeting of shareholders or directors

called for that purpose, unless the purchase by the Corporation of shares to

which the option relates would be illegal.

5. Purchase price. The purchase price of shares shall

be determined in accordance with the provisions of Exhibit A.

6. Pledge of shares prohibited. No shareholder shall

encumber or use any of the shares as security for any loan, except upon the

written consent of all of the parties to this agreement.

7. Payment of the purchase price.

7.1. The purchase price for shares shall be paid in

cash except that at the option of the purchasing party or parties _________

percent of the purchase price may be deferred and _________ percent paid at the

closing.

7.2. The deferred portion of the price shall be

evidenced by the promissory note of each purchasing party made payable to the

order of the selling party. The note of a purchasing party shall be in

substantially the form of that set forth in Exhibit B.

7.3. Notwithstanding paragraph 7.1, if the Corporation

or other purchasing party is the owner and beneficiary of any insurance on the

life of a deceased shareholder from whose estate the Corporation or other

purchasing party is purchasing shares, an amount equal to the death benefits

payable to the beneficiary under the policy or policies shall be paid in cash

to the estate of the deceased shareholder on account of the purchase price of

the shares, and only the balance, if any, may be deferred as provided in

paragraph 7.1. If the insurance proceeds exceed the purchase price of the

shares, the excess is the property of the Corporation or other purchasing

party.

7.4. If the Corporation is prohibited by law from

using all or any portion of the proceeds of the insurance policy or policies it

owns on the deceased shareholder's life, paragraph 7.3 shall apply only to

insurance proceeds which the Corporation may, by law, use to apply on the

purchase price of the shares.

8. The closing. Unless otherwise agreed by the

parties, the closing of the sale and purchase of shares shall take place at the

general offices of the Corporation.

8.1. In the case of a purchase of shares from a

deceased shareholder's estate under paragraph 1, the closing shall take place

_________ days after the appointment of a personal representative for the

deceased shareholder's estate. In the case of a purchase of shares under

paragraph 2 or 3, the closing of the sale and purchase shall take place

_________ days after the delivery to the selling shareholder of written notice

by the last of the purchasing party or parties to deliver notice of its, his,

her or their exercise of the option or options to purchase the selling

shareholder's shares. In either of these cases, if the determination of the net

worth of the Corporation by a certified public accounting firm is required,

under Exhibit B, the closing shall take place _________ days after the date on

which the firm files with the parties the determination, if that day is later

than either of the dates specified above.

8.2. Upon the closing of the sale and purchase, the

selling and purchasing parties shall execute and deliver to each other the

various documents which shall be required to carry out their undertakings

hereunder including the payment of cash, the execution and delivery of notes and

the assignment and delivery of stock certificates. Upon the closing the selling

shareholder shall deliver to the Corporation his or her resignation and that of

his or her nominees, if any, as officers and directors of the Corporation and

any of its subsidiaries.

8.3. The sale and purchase of shares which the

surviving or remaining shareholders are to purchase shall take place

immediately prior to the sale and purchase of shares, if any, which the

Corporation is to purchase.

9. Legend on certificate.

9.1. All shares owned by the shareholder, except as

provided in paragraph 4, shall be subject to the provisions of this agreement

and the certificates representing them shall bear the following legend:

The sale, transfer or encumbrance of this

certificate is subject to an agreement dated _________[date], among the

Corporation and certain of its shareholders. A copy of the agreement is on file

in the office of the Corporation. The agreement provides, among other things,

for certain obligations to sell and to purchase the shares of stock evidenced

by this certificate, for a designated purchase price. By accepting the shares

of stock evidenced by this certificate the holder agrees to be bound by that

agreement.

10. Termination.

10.1. This agreement and all restrictions on stock

transfers created shall terminate on the occurrence of any of the following

events:

(a). The bankruptcy or dissolution of the Corporation.

(b). A single shareholder's becoming the owner of all

of the shares of the Corporation, which are then subject to this agreement.

(c). The execution of a written instrument by the

Corporation and all of the shareholders who then own shares subject to this

agreement which terminates it.

10.2. Upon termination of this agreement, by reason of

the occurrence of any of the foregoing events, each shareholder shall have the

right within 30 days after termination to purchase from the Corporation, or

from any other shareholder (including the personal representative of a deceased

shareholder's estate) who owns an insurance policy, or policies, on his or her

life, the policy or policies, for cash in the amount of the cash surrender

value and the unearned net premiums both amounts as of the date of the

termination of the agreement.

10.3. This

agreement shall also terminate upon the death of all of the shareholders within

a period of 30 days of each other, in which case, the termination shall be

effective as of the day preceding the day of the death of the first

shareholder to die, and the shares and any insurance

policies owned by the Corporation or any deceased shareholder's estate shall be

owned free of the terms of this agreement.

10.4. The termination of this agreement for any reason

shall not affect any right or remedy existing prior to the effective date of

termination.

10.5. If under paragraph 2 or 3, all of a

shareholder's shares are transferred free of the terms but the transfer does

not terminate this agreement, then within _________ days from the date of

transfer the transferor of the shares shall have the right to purchase for

cash, policies of insurance on his or her life from the Corporation or the

other shareholders owning the policies, and the latter shall within _________

days have the right to purchase for cash, policies of insurance on each of

their lives from the transferor of shares owning the policies. The purchase

price of each policy shall be the cash surrender value plus the unearned

premium, both amounts as of the date the transferor's shares become free of the

terms of this agreement.

11. Insurance on shareholder's lives. The Corporation

may desire to insure, or partially insure, its promise in this agreement made

to purchase from a deceased shareholder's estate shares which he or she owned

prior to death. Therefore, the Corporation may purchase, and be the owner and

beneficiary of and may, from time to time, but shall not be obligated to

continue in force, insurance policies on the lives of the shareholders.

12. General provisions.

12.1. Governing law. This agreement shall be construed

pursuant to the laws of the State of _________.

12.2. Remedies for breach. The shares are unique and

each party to this agreement shall have the remedies which are available for

the violation of any of the terms of this agreement, including, but not limited

to, the equitable remedy of specific performance.

12.3. Notices. All notices provided for by this

agreement shall be made in writing (a) either by actual delivery of the notice

into the hands of the parties entitled, or (b) by the mailing of the notice in

the United States mails to the last known address of the party entitled,

registered mail, return receipt requested. The notice shall be deemed to be

received in case (a) on the date of its actual receipt by the party entitled

and in case (b), on the date of its mailing.

12.4. Descriptive headings. Titles to paragraphs are

for information purposes only.

12.5. Binding effect. This agreement is binding upon

and inures to the benefit of the Corporation, its successors and assigns and to

the shareholders and their respective heirs, personal representatives,

successors and assigns, and the shareholders by signing direct their personal

representatives to open their estates promptly in the courts of proper

jurisdiction and to execute, obtain and deliver all documents, including, but

not limited to, appropriate orders of the _________ Court (or court of

comparable jurisdiction) and estate and inheritance tax waivers, as shall be

required to effectuate the purpose of this agreement.

In witness, the Corporation and the shareholders have

executed this agreement on the date set forth above.

_________

Inc.

By: _________(Its

_________)

Attest:

_________(Its _________)

_________

_________

_______________

[Names and signatures of

shareholders.]

Exhibit A.

Determination of the Purchase Price

1. The price of shares to be purchased under this

agreement shall be the greater of the following:

(a) _________ percent times their fair market value on

the valuation date as defined below;

(b) _________ times the average pretax earnings for

the previous _________ fiscal years;

(c) The price determined under paragraph 6 if that

determination was made within _________ months of the valuation date.

2. The term "fair market value" as used in

paragraph 1 of this Exhibit A shall be an amount which bears the same

proportion to the amount of the net worth of the Corporation as the number of

shares to be purchased bears to the total number of the Corporation's shares

outstanding on the valuation date.

3. The valuation date, as used, shall be:

(a) in the case of a purchase under paragraph 1 of

this agreement, the last day of the month preceding the month in which the

death of the deceased shareholder occurred;

(b) in the case of a purchase under paragraph 2 of

this agreement, the last day of the month preceding the month in which the

Corporation received the notice of the proposed transfer as provided in

paragraph 2; or

(c) in the case of a purchase under paragraph 3 of

this agreement, the last day of the month preceding the month in which the

Corporation received actual notice of a transfer of shares;

provided, however, that, if the date so

determined follows by less than two calendar months the close of the

Corporation's last preceding fiscal year, then the last day of the fiscal year

shall be the valuation date.

4. Subject at all times to paragraph 6 of this Exhibit

A the term "net worth" as used in paragraph 2 of this Exhibit A shall

be an amount equal to the amount of the Corporation's assets, less the amount

of its liabilities, on the valuation date as disclosed by the Corporation's

books of account regularly maintained in accordance with generally accepted

accounting principles consistently applied but adjusted as follows:

(a). Insurance, if any, owned by the Corporation on

the life of a deceased shareholder whose shares are the subject of purchase

under paragraph 1 of this agreement shall be valued at its cash value on the

valuation date and not its face value.

(b). No adjustment shall be made on account of any

event occurring subsequent to the valuation date, whether the event constitutes

an adjustment to the federal or state income tax liability of the Corporation

or otherwise.

(c). Reserves for contingent liabilities shall not be

treated as liabilities.

(d). No amount shall be included for goodwill.

5. In the case of a purchase of shares under paragraph

2 of this agreement, if the price, if any, offered to the proposed transferee

is less than the purchase price determined under paragraph 4 or 5 of this

Exhibit A, that price rather than the price so determined shall be the price of

shares to be purchased under this agreement.

6. The shareholders and the Corporation, may, at any

time and from time to time determine "net worth" as used in paragraph

2 by executing and filing with the Corporation a written instrument where the

determination is set forth, whereupon, for the period of time stated in the

instrument "net worth" so determined shall supersede "net

worth" as determined in paragraph 4. This written instrument may but need

not read as follows:

The undersigned, being all the parties to that certain

stock purchase agreement dated _________[date], pursuant to paragraph 6

of Exhibit A to the agreement, agree that between _________[date], and _________[date],

both dates inclusive, the net worth of _________ Corporation shall be an amount

equal to _________.

(s)/_________

Corporation

By: _________(Its

_________)

_________

_________

7. The value of the Corporation's net worth, if

determined, as provided in paragraph 4 above, shall be determined by the firm

of certified public accountants regularly employed by the Corporation, or, if

for any reason this firm does not make the determination, then the

determination shall be made by any reputable firm of certified public

accountants employed for the purpose of the Corporation. The determination

shall be made from an examination of the Corporation's books of account, the

accuracy of which shall be assumed, a formal audit being expressly waived. The

waiver of audit shall not excuse the taking of inventories if inventories are a

material factor in the determination of net worth. The expense of determining

the net worth shall be borne by the Corporation.

Exhibit B.

Installment Promissory Note

_________[date].

For value received, the undersigned promises to pay,

to the order of _________ the principal sum of $_____ with interest at the

prime rate of the _________ Bank on the date of payment, per annum from this

date on any principal sum balance from time to time unpaid. The principal sum

of this note shall be paid in equal annual installments, the first installment

to be payable at the end of one year from this date on any principal sum

balance from time to time unpaid. The principal sum of this note shall be paid

in three equal annual installments, the first installment to be payable at the

end of one year from this date and the remaining installments at the end of

each succeeding year until the principal sum of this note is paid. Interest

accruing from time to time on the principal sum shall be paid at the times

provided above for payments of installments of the principal sum. Payments of

principal sum and interest shall be made at the place which the holder of this

note from time to time shall direct in writing. Upon a default by the

undersigned to make any payment of principal or interest due and continuing for

_________ days after written notice is given by the holder to cure, then at the

option of the holder of this note, all unpaid installments of principal and

accrued interest due shall become immediately due and payable.

At the option of the undersigned, all or any portion

of the unpaid principal sum and accrued interest on this note may be prepaid

without premium or penalty, the amount of the prepayment to be applied first to

accrued interest and the remainder to unpaid principal installments as the

undersigned shall designate in a written prepayment notice delivered to the

holder of this note concurrently with the making of the prepayment, provided

that no prepayment can be made during the calendar year in which the note is

executed.

_________

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

Keywords: Section 303 redemption

|

|

|