|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

Primary area of practice |

please specify field of law here:

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

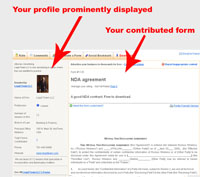

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

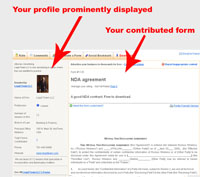

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Your Name – enter your name or nickname as you want it displayed |

|

|

Name of Business |

|

|

2nd area of practice: (optional) |

please specify field of law here:

|

|

3rd area of practice: |

please specify field of law here:

|

|

4th area of practice: |

please specify field of law here:

|

|

5th area of practice: |

please specify field of law here:

|

|

Location – where you practice law (fill in as many fields as you

would like) |

|

|

|

Note: your profile does not go live until

you contribute a form

|

|

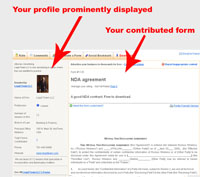

Click image below to see how we display your

profile

|

- Receive a free profile listing your firm's areas of expertise

- All contributed forms prominently display your business profile,

which include the optional fields of your phone number, email, and website address(see

example in top right)

- Connect with thousands of businesses, professionals, and potential

customers looking to use your expertise and services

- Your form will be highly optimized for the search engines, enabling people doing

keyword searches related to your business to find you via the profile we display

about you

- Feel good by giving back to the community by providing quality legal and business

forms for free

- You're protected: all users who download your forms agree to idemnify you Learn More

|

|

|

Our Spam Policy

We hate getting spam as much as you do. So we have implemented a tough spam policy

regading how we deal with your email. We pledge that we will:

- Never rent, trade, or sell any email or any personal information to any third

party without your explicit consent

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your agreement

to hold this site, its officers, employees and any contributors to this site harmless

for any damage you might incur from your use of any submissions contained on this

site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

Close

Thank you for using

Yourfreelegalforms.com

Your online source for 100% free legal and business forms.

Have a form to contribute?

Contribute a legal or business form, checklist or article and have your profile

displayed on the same page as the form for free, powerfull, targeted marketing to

those searching for legal forms and advice.

Rate this form

(must be logged in)

|

|

Social Bookmark this Form

|

|

|

Advertise your business to thousands for free –

Contribute a form

|

|

Form #1114PPM Stock Subscription Agreement

|

PPM Stock Subscription Agreement - free to use and download

|

Need this form customized?

Need this form customized? |

Download This Form

Download This Form

|

Printer Friendly Version

Terms Of Use

Submissions to this site, including any legal or business forms, posts, responses

to questions or other communications by contributors are not intended as and should

not be construed as legal advice. You are strongly encouraged to consult competent

legal council before engaging in any action based upon content contained on this

site.

These downloadable forms are only for personal use. Retransmission, redistribution,

or any other commercial use is prohibited. This includes reposting forms from this

site to another site offering free legal or other document forms for download.

Please note that the donator may have included different usage terms regarding this

form, and you agree to abide by these terms. It is highly recommended that you have

a licensed attorney review any legal documents for which you are searching in order

to make sure that your needs are being properly and completely satisfied.

Your use of this site constitutes your acceptance of our terms of use and your

agreement to hold this site, its officers, employees and any contributors to this

site harmless for any damage you might incur from your use of any submissions contained

on this site. If you do not agree to the above terms, please do not proceed.

These forms are provided to assist business owners and others in understanding important

points to consider in different transactions. They are offered with the understanding

that no legal advice, accounting, or other professional service is being offered

by these documents or on this website. Laws vary in the different states. Agreements

acceptable in one state may not be enforced the same way under the laws of another

state. Also, agreements should relate specifically to the particular facts of each

situation. Therefore, it is important to consult legal counsel whenever utilizing

these forms. The Forms are not a substitute for legal advice. YourFreeLegalForms.com

is not engaged in recommending or referring members on the site or making claims

about the competence, character or qualifications of its participating members.

|

Copy No.

CONFIDENTIAL PRIVATE PLACEMENT

MEMORANDUM: SUBSCRIPTION

AGREEMENT AND CLOSING DOCUMENTS

Each prospective purchaser is urged to consult with his

or her own advisers to determine the suitability of an investment in Common

Shares (“the Shares”), and the relationship of such an investment to the

purchaser’s overall investment program and financial and tax position. Each

purchaser of Shares will be required to further represent that, after all

necessary advice and analysis, such purchaser’s investment in Shares is

suitable and appropriate, in light of the foregoing considerations.

SUBSCRIPTION

AGREEMENT

Each person who wishes to subscribe for Shares (a

“Subscriber”) must return an executed Subscription Agreement to “COMPANY NAME”,

which subscription must be accepted by the Company. A Subscription Agreement

will be sent separately to each Subscriber.

In the Subscription Agreement, each subscriber for Shares

will acknowledge that it is committing to purchase Shares from “Seller’s Name”,

pursuant to the offering. Each subscriber will also acknowledge that it has

received, read and understood the contents of this Private Placement Memorandum

and the Exhibits. By executing the Subscription Agreement, each Subscriber

covenants that, to the extent such Subscriber receives Shares directly or

indirectly, it will execute the Stockholders’ Agreement. In addition, by

executing the Subscription Agreement, each Subscriber represents and warrants

to the Company, among other things, that it is an “accredited investor” as

defined in Rule 501(a) of Regulation D under the Securities Act, and that it is

acquiring the Shares exclusively for its own account without a view to the

distribution of any part thereof. In connection with sales of Shares to a

non-U.S. person, “COMPANY NAME” may require a legal opinion with respect to

compliance with the securities laws of that person’s jurisdiction of residence

and other matters.

Once the Subscriber has completed the Subscription

Agreement, he, she or it should sign and date, as applicable, the Subscription

Agreement and the Signature Page and return them to “Officer’s Name”, together

with a certified check or cashier’s check made payable to ““COMPANY NAME” LLC.”

(or may wire funds to an account designated by The Company) in the amount that

they specify in the Subscription Agreement. All subscriptions are subject to

acceptance by The Company. If The Company rejects your subscription, “COMPANY

NAME” will return your subscription to you without interest. “COMPANY NAME”

will deposit all

subscriptions in its bank account pending the closing

of the offering, and subscribers will not be entitled to interest on payments

sent to The Company.

If you have questions regarding the forms or how to

complete them, you may call “Officer’s Name” at “PHONE NUMBER”.

Eligible Investors

Shares may be purchased only by investors who qualify as

“accredited investors” as defined in Rule 501(a) of Regulation D under the

Securities Act (see Exhibit C attached hereto).

The Shares are suitable investments only for sophisticated

investors for whom an investment in The Company does not constitute a complete

investment program and who fully understand, are willing to assume, and have

the financial resources necessary to withstand the risks involved in an investment

in The Company and who are able to bear the potential loss of their entire

investment in the Shares. Investors should not rely on The Company for

short-term financial needs or for short-term investment in the stock market.

“COMPANY NAME” is intended to be part of a well-balanced, comprehensive

investment program. Prospective investors will be required to make appropriate

representations to The Company to evidence the foregoing.

Except as otherwise may be consented to by The Company,

investors must meet all of the eligibility criteria set forth above and in The

Company’s subscription documents, and “COMPANY NAME” reserves the right to

reject initial or additional subscriptions in its absolute discretion.

The foregoing is only a summary and is qualified in its

entirety by reference to the Subscription Agreement, a copy of which is

attached hereto as Exhibit A. Potential investors should read the Subscription

Agreement carefully.

STOCKHOLDERS’ AGREEMENT

As a condition precedent to the issuance of the Shares

offered hereby, each investor will enter into a Stockholders’ Agreement with

the Company and the principals and management stockholders of the Company, the

material terms of which are summarized below:

Registration Rights: Following the Company’s initial

public offering, the investors will be entitled to participate in any

registration by the Company, whether it is for its own account or for the

account of other stockholders (subject to certain exceptions). The number of

Shares that the investors may include in such registration may be reduced by

the Company or the managing underwriter, if any, if the Company or such

underwriter determines in good faith that market conditions and similar factors

require such a reduction. The registration rights may not be assigned to a

transferee who acquires less than two percent of the Shares issued pursuant to

this offering or to a competitor of the Company. The registration rights will

expire on the earlier of four years after the Company’s initial public offering

or, with respect to a particular investor, the date when the Shares held by

such investor may be sold in a single transaction pursuant to Rule 144 under

the Securities Act. The investors will not be permitted to sell, or offer to

sell, any securities of the Company during the 180-day period following the

Company’s initial public offering.

Information Rights: The Company shall provide each

investor with financial statements within 120 days after the end of each fiscal

year. The information rights will terminate upon a public offering by the

Company following which the Company is required to publicly report financial

statements.

Co-Sale Rights: The investors will be entitled to

participate in any sale by one or more of the Company’s principals of at least

“PERCENTAGE” percent or more of the issued and outstanding (on a fully diluted

basis) shares of Common Stock, on a pro rata basis and on the same terms and

conditions as apply to the selling principals. This co-sale right must be

exercised within 120 days following delivery to the investors of the

principals’ notice setting forth the terms of the proposed sale, and will

expire upon the effective date of the Company’s initial public offering. The

co-sale right will not apply to a transfer to affiliates, family members,

family trusts or the estate of a selling founder, provided that such transferee

agrees to become a party to the Stockholders’ Agreement.

Drag-Along Rights: In the event the principals

propose to transfer at least “PERCENTAGE” percent of the shares of Common Stock

held by them to a bona fide third-party purchaser, the principals may require

the investors to sell, or cause to be sold, to such third-party purchaser all

of their shares of Common Stock on the same terms and conditions as apply to the

principals. This drag-along right will expire upon the effective date of the

Company’s initial public offering.

Right of First Refusal: The Company shall have a

right of first refusal to purchase all or any of such shares of Common Stock as

are proposed to be sold by an investor on the same terms and conditions as

apply to the proposed transferee. This restriction will expire upon the

Company’s initial public offering and will not apply to transfers to partners,

affiliates, family members, family trusts or the estate of a selling investor,

provided that any such transferee agrees to become a party to the Stockholders’

Agreement.

Restrictions on Transfer. Investors will not be

permitted to transfer shares of Common Stock to a competitor of the Company.

Amendment. The Stockholders’ Agreement may only be

amended by the written consent of the Company, the principals, or, as to the

investors, by the holders of a majority of the shares of Common Stock held by

the investors and their assignees.

Term. The Stockholders’ Agreement will terminate on

the earliest of (i) the date when the investors no longer hold shares of Common

Stock, (ii) four years after the Company’s initial public offering and (iii)

when the rights granted thereunder have terminated.

The foregoing is only a summary and is qualified in its

entirety by reference to the Stockholders’ Agreement, a copy of which is

attached hereto as Exhibit B. Potential investors should read the Stockholders’

Agreement carefully.

Additional Information

“COMPANY NAME” will make available to any proposed

investor such additional information as it may possess, or as it can acquire

without unreasonable effort or expense, to verify or supplement the information

set forth herein.

EXHIBIT A

TO

“COMPANY NAME-PRIVATE PLACEMENT MEMORANDUM

SUBSCRIPTION AGREEMENT

DATED AS OF “DATE”

SUBSCRIPTION AGREEMENT

“Company Name”

THIS AGREEMENT IS BEING ENTERED INTO IN RELIANCE ON

CERTAIN EXEMPTIONS FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS

AMENDED (THE “SECURITIES ACT”), INCLUDING BUT NOT LIMITED TO THOSE SET FORTH IN

REGULATION D PROMULGATED THEREUNDER, AND APPLICABLE STATE SECURITIES

LAWS. THE SECURITIES OFFERED HEREBY HAVE NOT BEEN APPROVED OR DISAPPROVED BY

THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES LAW

ADMINISTRATOR, NOR HAS THE SECURITIES AND EXCHANGE COMMISSION OR ANY STATE

SECURITIES LAW ADMINISTRATOR PASSED ON THE ACCURACY OR ADEQUACY OF THE

INFORMATION PROVIDED. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

A PURCHASER OF THE SECURITIES OF THE COMPANY OFFERED

HEREBY MUST BE PREPARED TO BEAR THE ECONOMIC RISK OF THE INVESTMENT FOR AN

INDEFINITE PERIOD OF TIME BECAUSE THE SECURITIES HAVE NOT BEEN REGISTERED UNDER

THE SECURITIES ACT AND, THEREFORE, CANNOT BE OFFERED, SOLD, TRANSFERRED,

PLEDGED OR HYPOTHECATED UNLESS THEY ARE SUBSEQUENTLY REGISTERED OR AN EXEMPTION

FROM REGISTRATION IS AVAILABLE. THE ISSUER IS UNDER NO OBLIGATION TO REGISTER

THE SECURITIES OFFERED HEREBY UNDER THE SECURITIES ACT, EXCEPT AS EXPRESSLY SET

FORTH HEREIN.

THE SECURITIES OFFERED HEREBY HAVE NOT BEEN QUALIFIED

UNDER APPLICABLE STATE SECURITIES LAWS AND CANNOT BE OFFERED, SOLD, TRANSFERRED

OR HYPOTHECATED IN THE ABSENCE OF QUALIFICATION UNDER APPLICABLE STATE SECURITIES

LAWS UNLESS AN EXEMPTION FROM QUALIFICATION IS AVAILABLE.

EACH PROSPECTIVE PURCHASER MUST COMPLY WITH ALL

APPLICABLE LAWS AND REGULATIONS IN FORCE IN ANY JURISDICTION IN WHICH IT

PURCHASES, OFFERS OR SELLS THE SECURITIES AND MUST OBTAIN ANY CONSENT, APPROVAL

OR PERMISSION REQUIRED BY IT FOR THE PURCHASE, OFFER OR SALE BY IT OF THE

SECURITIES UNDER THE LAWS AND REGULATIONS IN FORCE IN ANY JURISDICTION TO WHICH

IT IS SUBJECT OR IN WHICH IT MAKES SUCH PURCHASES, OFFERS OR RESALES, AND THE

COMPANY SHALL NOT HAVE ANY RESPONSIBILITY THEREFOR.

THIS SUBSCRIPTION AGREEMENT (this “Agreement” or

“Subscription Agreement”) is made and entered into as of the date the

subscription evidenced hereby is accepted, by and among “COMPANY NAME”, a

“STATE” corporation (the “Company”), and the undersigned (each, the

“Purchaser”).

THE PARTIES HEREBY AGREE AS FOLLOWS:

. Subject to the terms and conditions of this Agreement, on

the Closing Date (as defined in Section 2 below) applicable to the Purchaser,

the Company shall issue and sell to the Purchaser, and the Purchaser agrees to

purchase from the Company, that number of shares (the “Shares”) of the The

Company’s Common Stock, par value $ .001 per share (the “Common Stock”) set

forth on the signature page executed by the Purchaser and attached hereto (the

“Purchased Shares”) at a purchase price of $.00 per share (the “Purchase

Price”). The Purchaser’s payment of the Purchase Price shall be delivered to

the Company on or before the Closing Date (as hereinafter defined) applicable

to the Purchaser’s investment. The purchase of the Purchased Shares is in

connection with the Company’s offering (the “Offering”) of Shares pursuant to

the Company’s Private Placement Memorandum, dated as of “DATE”, “YEAR” (the

“Private Placement Memorandum”).

. The Offering will terminate on the earlier of an

election by the Company to not accept further subscriptions, or the sale of

all Shares offered in the Offering, (the “Offering Termination Date”). All

Offering proceeds received prior to a closing will be placed in a segregated

account maintained by the Company and distributed to the Company upon such

closing. All closings shall be held at the offices of “Company Name”

“COMPANY ADDRESS”, or at such other time and place as the Company and the

Purchaser may mutually agree. (The dates of each of such closings shall be

collectively referred to herein as the “Closing Date.”)

2.2 Issuance of

Shares

. Subject to the terms and conditions hereof, on the

Closing Date applicable to the Purchaser, against the Purchaser’s payment to

the Company of the Purchase Price, the Company shall issue to the Purchaser the

Purchased Shares.

. As soon as practicable after the Closing Date

applicable to the Purchased Shares, the Company will deliver to the Purchaser

certificates representing the Purchased Shares, which certificates shall be

issued in the Purchaser’s name as set forth on the signature page of this

Agreement.

. The Purchaser shall subscribe for the Shares by

(i) indicating on the signature page hereof the number of Shares Purchaser

desires to purchase, and the Purchase Price for such Shares,

(ii) executing this Agreement and fully completing and executing the

Investor Questionnaire attached hereto as Exhibit “1” (the

“Questionnaire”) and the Stockholders’ Agreement attached hereto as Exhibit

“2” (the “Stockholders’ Agreement”), and

(iii) sending such documents by courier or express

mail along with a check in an amount equal to the Purchase Price payable to

““Company Name” ” (unless the Purchase Price is being sent by wire transfer)

to:

“Company Name”

“COMPANY ADDRESS”

Attention: “Officer’s Name”

. The issuance of a certificate representing the Purchased

Shares acquired by the Purchaser shall constitute the Company’s acceptance of

the Purchaser’s investment. No subscriptions will be accepted that do not

include (a) a completed and executed Subscription Agreement, (b) a

completed and executed Questionnaire, (c) a completed and executed

Stockholders’ Agreement, and (d) payment of the Purchase Price by check or

by wire transfer in accordance with Section 3.1 hereof. The Company

reserves the right, in its sole discretion, to reject any subscription if it

believes the subscriber does not meet the qualifications to invest in the

Shares or for any other reason.

. The Company hereby represents and warrants to each

Purchaser that:

. The Company is a corporation duly organized and

existing under the laws of the State of “STATE” and is in good standing under

such laws. The Company has the requisite corporate power to own and operate

its properties and assets, and to carry on its business as presently conducted

and as proposed to be conducted as provided in the Private Placement

Memorandum, a copy of which has been provided to each Purchaser.

. The Company will have at the Closing Date all

requisite legal and corporate power and authority to enter into this Agreement

and the Stockholders’ Agreement (collectively, the “Investment Agreements”), to

sell and issue the Purchased Shares as provided herein, and to carry out and

perform its obligations under the terms of the Investment Agreements.

Except for its interest in THE COMPANY, The Company does

not own or control, directly or indirectly, any interest or investment in any

other corporation, association, partnership or other business entity. .

. All corporate action on the part of the Company, its

officers, directors and shareholders necessary for the authorization,

execution, delivery and performance of the Investment Agreements by the Company

and the authorization, sale, issuance and delivery of the Purchased Shares

pursuant hereto and the performance of all of the Company’s obligations under

the Investment Agreements has been taken or will be taken at or prior to the

Closing Date. The Investment Agreements, when executed and delivered by the Company,

shall constitute valid and binding obligations of the Company, enforceable in

accordance with their terms, except as enforcement may be limited by applicable

bankruptcy laws or other similar laws

affecting creditors’ rights generally, and the availability

of equitable remedies may be limited by applicable law. The Purchased Shares,

when issued in accordance with the provisions of this Agreement and the Private

Placement Memorandum, will be validly issued, fully paid and nonassessable.

The Purchased Shares will be free of any liens or encumbrances other than any

liens or encumbrances created by or imposed upon the Purchaser; provided,

however, that the Purchased Shares may be subject to restrictions on transfer

under state and/or federal securities laws.

. The Company has good and marketable title to its

material properties and assets and has good title to all its leasehold

interests, in each case subject to no mortgage, pledge, lien, lease,

encumbrance or charge, other than (i) the lien of current taxes not yet

due and payable, and (ii) liens and encumbrances which do not,

individually or in the aggregate, materially detract from the value of the

property subject thereto or materially impair the operations of the Company and

which have not arisen other than in the ordinary course of business.

. “COMPANY NAME” is not in violation of or default under

(i) any term of its Certificate of Incorporation (the “Certificate of

Incorporation”) or its Bylaws, as amended (the “Bylaws”), (ii) to the

knowledge of the Company, in any material respect of any term or provision of

any material mortgage, indebtedness, indenture, contract, agreement,

instrument, judgment, order or decree, or (iii) to the knowledge of the

Company, any statute, rule or regulation applicable to The Company or “COMPANY

NAME” in each case where such violation would materially and adversely affect

the Company. To the knowledge of the Company, the execution, delivery and

performance of the Investment Agreements and the issuance of the Shares have

not resulted in, and will not result in, any material violation of, or conflict

with, or constitute with or without the passage of time and the giving of

notice a material violation or default under, the Certificate of Incorporation

or the Bylaws or any such material agreements except where the violation,

conflict, or default would not (a) have a material adverse effect on the

ability of the parties hereto to consummate the transaction contemplated by

this Agreement, (b) have a material adverse

effect on the Company’s business operations, and

(c) result in the creation of, any mortgage, pledge, lien, encumbrance or

charge upon any of the properties or assets of the Company.

. There are no material actions, suits, proceedings or

investigations pending or, to the knowledge of the Company, threatened against

or affecting the Company or its properties before any court or governmental

agency. To the knowledge of the Company, the Company is not subject to the

provisions of any order, writ, injunction, judgment or decree of any court or

government agency or instrumentality.

. To the Company’s knowledge, no employee of the Company

is in violation of any term of any employment contract, patent disclosure

agreement or any other contract or agreement relating to the relationship of

such employee with the Company or any other party because of the nature of the

business conducted or to be conducted by the Company.

To the Company’s knowledge, no consent, approval or

authorization of or designation, declaration or filing with any governmental

authority on the part of the Company is required in connection with the valid

execution and delivery of this Agreement, or the offer, sale or issuance of the

Shares, or the consummation of any other transaction contemplated hereby,

except for the making of filings and the payment of fees as may be necessary

under any applicable Blue Sky laws, which filings and payments of fees, if

required, will be accomplished in a timely manner, except where the failure to

file or pay any such fee would not (i) have a material adverse effect on

the ability of the parties hereto to consummate the transaction contemplated by

this Agreement or (ii) have a material adverse effect on the Company’s

business operations..

4.12 . Except as described in the

Private Placement Memorandum, there are no obligations of the Company to

officers, directors or employees of the Company other than (a) for payment

of salary and stock options for services rendered, (b) for reimbursement

for reasonable expenses incurred on behalf of the Company, and (c) for

other standard employee benefits made generally available to all employees of

the Company. To the Company’s knowledge, none of the officers or directors of

the Company, or any members of their immediate families, are indebted to the

Company or have any direct or indirect ownership interest in any firm or

corporation with which the Company is affiliated or with which the Company has

a business relationship, or any firm or corporation which competes with the

Company, except that such persons may own stock in publicly traded companies

which may compete with the Company or have a business relationship with the

Company. To the Company’s knowledge, no officer or director, or any member of

their immediate families is, directly or indirectly, interested in any material

contract with the Company, other than such contracts as relate to any such

person’s ownership of capital stock or other securities of the Company or employment

with the Company.

. Purchaser hereby represents and warrants to the

Company as follows:

. If the Purchaser is not a natural person, the Purchaser

is a corporation, partnership, trust or other organization (as indicated by its

signature to this Agreement) and is

duly organized, validly existing and in good standing

under the laws of the jurisdiction of its organization. The Purchaser has now,

and will have at the applicable Closing Date, all requisite legal and (if

applicable) corporate, partnership or other power to enter into this Agreement,

to purchase the Shares hereunder and to perform its obligations under the terms

of this Agreement.

. All corporate, partnership or other action on the part

of the Purchaser necessary for the purchase of the Purchased Shares and the

performance of Purchaser’s obligations hereunder has been taken or will be

taken prior to the applicable Closing Date. This Agreement, when executed and

delivered by the Purchaser, will constitute a valid and legally binding

obligation of the Purchaser, enforceable in accordance with its terms, except

as enforcement may be limited by (i) applicable bankruptcy laws or other

similar laws affecting creditors’ rights generally, and (ii) the

availability of equitable remedies.

. This Agreement is made with the Purchaser in reliance

on the following specific representations to the Company that:

. The Purchaser understands that the Shares may be

restricted securities within the meaning of Rule 144 promulgated under the

Securities Act; that the Shares are not registered under the Securities Act,

that the Purchaser may be required to hold the Shares

indefinitely unless they are subsequently registered or

an exemption from such registration is available; that, in any event, if the

Shares are restricted securities, the exemption from registration under

Rule 144 would not be available for at least one year, and even then, if

the Purchaser is an affiliate of the Company or has held such Shares for less

than two years, such exemption will not be available unless: (i) a public

trading market then exists for the Shares; (ii) adequate information

concerning the Company is then available to the public; and (iii) other

terms and conditions of Rule 144 are complied with, including, among other

things, the sale being made through a broker in an unsolicited “broker’s

transaction” or in transactions directly with a “market maker” and the number

of such Shares sold in any three‑month period not exceeding specified

limitations.

. The Purchaser understands that no public market now

exists for any of the securities issued by the Company and that the Company has

made no assurances that a public market will ever exist for the Company’s

securities.

. The Purchaser has had an opportunity to discuss the

Company’s business, management and financial affairs with its management. It

has also had an opportunity to ask questions of officers of the Company, which

questions were answered to its satisfaction. The Purchaser understands that

such discussions, as well as any written information issued by the Company,

were intended to describe certain aspects of the Company’s business and

prospects but were not a thorough or exhaustive description.

. The Company may at its discretion pay brokers or

finders fees in connection with this offering.

. The Purchaser has reviewed with its own tax advisors,

the federal, state, local and foreign tax consequences of this investment and

the transactions contemplated by this Agreement. The Purchaser has relied

solely on such advisors and not on any statements or representations of the

Company or any of its agents. The Purchaser understands that it (and not the

Company) shall be responsible for its own tax liability that may arise as a

result of this investment or the transactions contemplated by this Agreement.

. The Purchaser qualifies as an “accredited investor”

pursuant to Rule 501(a) of Regulation D promulgated by the Securities and

Exchange Commission (the “Commission”) under the Securities Act.

. The obligation of the Purchaser to purchase the Shares

on the applicable Closing Date is subject to the fulfillment on or prior to

such Closing Date of the following conditions:

. The Company’s obligation to sell and issue the

Purchased Shares on the applicable Closing Date is subject to the fulfillment on

or prior to such Closing Date of the following conditions:

. Each certificate representing the Shares shall be

stamped or otherwise imprinted with a legend in substantially the following

form:

THE SECURITIES REPRESENTED HEREBY HAVE NOT BEEN REGISTERED

UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR

QUALIFIED UNDER APPLICABLE STATE SECURITIES LAWS (THE “LAWS”) AND MAY NOT BE

OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED IN THE ABSENCE

OF AN EFFECTIVE REGISTRATION STATEMENT COVERING THE SECURITIES UNDER THE

SECURITIES ACT AND THE QUALIFICATION OF THE SECURITIES UNDER THE LAWS, UNLESS

THE COMPANY AND ITS COUNSEL ARE SATISFIED THAT SUCH REGISTRATION AND

QUALIFICATION IS NOT THEN REQUIRED UNDER THE CIRCUMSTANCES

OF SUCH OFFER, SALE, TRANSFER, PLEDGE OR HYPOTHECATION.

Such legend shall be removed by the Company upon delivery

to it of an opinion of counsel satisfactory to the Company in form and

substance satisfactory to the Company, that a registration statement under the

Securities Act and qualification under applicable state securities laws is at

the time in effect with respect to the legended security or that such security can

be freely transferred without such registration and qualification.

. Any certificate representing the Shares shall also be

endorsed with any legend or legends required by the securities laws of the

jurisdictions of the residence of the Purchaser.

. The Shares may not be transferred unless and until one

of the following events shall have occurred:

The restrictions on transfer imposed by this Section 7.3

shall cease and terminate as to the Shares or any portion thereof when

(i) such Shares shall have been effectively registered under the

Securities Act and sold by the holder thereof in accordance with such

registration, or (ii) the Company is provided with an acceptable opinion

of counsel as described in subparagraph (a) above to the effect that all future

transfers of such Shares by the transferor or the contemplated transferee would

be exempt from registration under the Securities Act.

. This Agreement shall be governed in all respects by

the laws of the State of “STATE” without application of principles of

conflicts of laws.

. The representations, warranties, covenants and

agreements made herein shall survive the closing of the transactions

contemplated hereby.

. Except as otherwise expressly provided herein, the

provisions hereof shall inure to the benefit of, and be binding upon, the

successors, assigns, heirs, executors and administrators of the parties hereto.

(a) This Agreement and the other documents

delivered pursuant hereto constitute the full and entire understanding and

agreement between the parties with regard to the subjects hereof and thereof.

Any provision of this Agreement may be

All notices and other communications required or

permitted hereunder shall be in writing and shall be (i) delivered

personally or by facsimile, (ii) transmitted by first‑class mail,

postage prepaid, or airmail, postage prepaid, in the event of mailing for

delivery outside of the country in which mailed, or (iii) transmitted by

an overnight courier of recognized reputation or of recognized international

reputation in the event of an international delivery addressed (a) if to

the Purchaser, at its address as set forth on the signature pages hereto, or at

such other address as such Purchaser shall have furnished to the Company in

writing, or (b) if to any other holder of any Shares at such address as

such holder shall have furnished the Company in writing, or, until any such

holder so furnishes an address to the Company, then to and at the address of

the last holder of such Shares who has so furnished an address to the Company,

or (c) if to the Company, at its address set forth at the signature page

of this Agreement, or at such other address as the Company shall have furnished

to each such holder in writing. Except as otherwise specified herein, all

notices and other communications shall be deemed to have been duly given on

(A) the date of receipt if delivered personally or by facsimile,

(B) the date three (3) days after posting if transmitted by mail, or (C) the

date one (1) day after delivery to the courier if sent by recognized or

internationally recognized overnight courier service, whichever shall first

occur.

. Unless otherwise expressly provided herein, the rights

of the Purchaser hereunder are several rights, not rights jointly held with any

of the other purchasers of Shares in the Offering. Any invalidity, illegality

or limitation on the enforceability of any part of this Agreement, whether

arising by reason of the law of the Purchaser’s domicile or otherwise, shall in

no way affect or impair the validity, legality or enforceability of this

Agreement with respect to any other such purchaser or purchasers. In case any

provision of this Agreement shall be invalid, illegal or unenforceable, the

validity, legality and enforceability of the remaining provisions shall not in

any way be affected or impaired thereby.

. The titles of the paragraphs and subparagraphs of this

Agreement are for convenience of reference only and are not to be considered in

construing this Agreement.

. This Agreement may be executed in any number of

counterparts, each of which shall be an original, but all of which together

shall constitute one instrument.

. The Company shall pay all costs and expenses that it

incurs with respect to the negotiation, execution, delivery and performance of

the Investment Agreements and each Purchaser shall pay all costs and expenses

that he, she or it incurs with respect to the negotiation, execution, delivery

and performance of the Investment Agreements.

. Except as expressly provided herein, no delay or

omission to exercise any right, power or remedy accruing to any holder of any

Shares, upon any breach or default of the Company under this Agreement, shall

impair any such right, power or remedy of such holder nor shall it be construed

to be a waiver of any such breach or default, or an acquiescence therein, or of

or in any similar breach or default thereafter occurring; nor shall any waiver

of any single breach or default be deemed a waiver of any other breach or

default theretofore or thereafter occurring. Any waiver, permit, consent or

approval of any kind or character on the part of any holder of any breach or

default under this Agreement, or any waiver on the part of any holder of any

provisions or conditions of this Agreement, must be in writing and shall be

effective only to the extent specifically set forth in such writing. All remedies,

whether under this Agreement or by law or otherwise afforded to any holder,

shall be cumulative and not alternative.

IN WITNESS WHEREOF, the

parties have entered into this Agreement as of the day and year first written

above.

SIGNATURE OF INDIVIDUAL

PURCHASERS:

|

Signature

|

|

Signature (if jointly held)

|

|

Print Name

Address:_________________

_________________

_________________

Telephone:_______________

Facsimile:________________

e-mail:___________________

|

|

Print Name

Address:_________________

_________________

_________________

Telephone:_______________

Facsimile:________________

e-mail:___________________

|

|

Executed at:

City, State

|

|

Date:

|

Professional Adviser(s)/Purchaser Representative(s)

(if applicable)

Signature

Print Name

Executed at:

|

___________________________

City, State

|

Date:

|

NUMBER OF SHARES:

____________________X “Price per Share” per share

TOTAL PURCHASE PRICE: $

SIGNATURE OF PURCHASERS WHO ARE CORPORATIONS, TRUSTS

OR PARTNERSHIPS:

Name of entity (please print or type)

Signature(s) of authorized agent, trustee or general partner(s)

Title of authorized agent, trustee or general partner

Address:______________________________________________

______________________________________________

______________________________________________

Telephone:____________________________________________

Facsimile:_____________________________________________

e-mail:________________________________________________

Executed at: Date:

City, State

NUMBER OF SHARES: X”Price

per Share” Per Share

PURCHASE PRICE: $

SIGNATURE OF THE COMPANY:

The foregoing subscription is hereby accepted by:

“COMPANY NAME”

“COMPANY ADDRESS”.

Facsimile No.: “FAX”

By:

“Officer’s Name”

Executed at: Date:

City, State

EXHIBIT 1

TO

“COMPANY NAME” SUBSCRIPTION AGREEMENT

INVESTOR QUESTIONNAIRE

“COMPANY NAME”.

INVESTOR QUESTIONNAIRE

INTRODUCTORY STATEMENT

The undersigned is being asked to complete this Investor

Questionnaire in connection with the undersigned’s purchase of certain

securities (the “Securities”) of “Company Name” LLC, a “STATE” Limited

Liability Corporation (the “Company”) in connection with the Company’s offering

(the “Offering”) of shares of the Company’s common Stock (the “Common Stock”)

pursuant to the Company’s Private Placement Memorandum, dated as of “DATE”th,

“YEAR” (the “Offering Memorandum”), and subject to the terms and conditions of

that certain Subscription Agreement, dated as of “DATE”, “YEAR” (the

“Subscription Agreement”), by and among the Company and the purchasers

signatory thereto (the “Purchasers”). Capitalized terms used in this Investor

Questionnaire shall have the meanings as set forth in the Subscription

Agreement. The undersigned’s receipt of the Securities is conditioned upon the

satisfactorily completion of this Investor Questionnaire.

The Company will not deliver the Securities to any person

that is not an “accredited investor”, as defined in Rule 501 promulgated under

the Securities Act of 1933, as amended (the “Act”). The purpose of this

Investor Questionnaire is to represent to the Company that the undersigned

meets the standards imposed by any applicable state securities laws and

Regulation D promulgated under the Act, since the Securities will not be

registered under the Act or under state securities laws.

By signing this Investor Questionnaire, the undersigned

agrees that the Company may present a copy of this Investor Questionnaire to

such persons as the Company deems appropriate if called upon under law to

establish the availability under the Act or state securities laws of an

exemption from registration for the offer and sale of the Securities.

This Investor Questionnaire is not an offer to sell,

nor is it a solicitation for an offer to buy, any Securities.

Please complete the entire Investor Questionnaire and

return it to the address set forth below:

“COMPANY

NAME”

“COMPANY

ADDRESS”.

Fax:

“FAX”

INVESTOR QUESTIONNAIRE

“COMPANY NAME”

ALL INFORMATION WILL BE TREATED CONFIDENTIALLY

1. The undersigned acknowledges that any offer

and sale of Securities will not be registered with the Securities and Exchange

Commission because the Company will rely upon exemptions from registration

under the Act in connection with such offer and sale. The undersigned

understands that all investors must be Accredited Investors, as defined

in Rule 501 of Regulation D under the Act, and that the Company will not

deliver any Securities to any person who has not confirmed that such person is

an Accredited Investor.

Accredited Investor - The undersigned

hereby confirms to the Company that such person (check each category which

applies):

(a) is a bank as defined in Section 3(a)(2)

of the Act or a savings and loan association or other institution as defined in

Section 3(a)(5)(A) of the Act, whether acting in its individual or fiduciary

capacity; a broker dealer registered pursuant to Section 15 of the Securities

Exchange Act of 1934; an insurance company as defined in Section 2(13) of the

Act; an investment company registered under the Investment Company Act of 1940

or a business development company as defined in Section 2(a)(48) of the

Investment Company Act of 1940; a Small Business Investment Company licensed by

the U.S. Small Business Administration under Section 301(c) or (d) of the Small

Business Investment Act of 1958; a plan established and maintained by a state,

its political subdivisions, or any agency or instrumentality of a state or its

political subdivisions, for the benefit of its employees, if such plan has

total assets in excess of $”AMOUNT OF OFFERING”; an employee benefit plan

within the meaning of the Employee Retirement Income Security Act of 1974, if

the investment decision is made by a plan fiduciary, as defined in Section

3(21) of such Act, which plan fiduciary is either a bank, savings and loan

association, insurance company, or registered investment adviser, or if the

employee benefit plan has total assets in excess of $”AMOUNT OF OFFERING” or,

if a self-directed plan, with investment decisions made solely by persons that

are accredited investors;

(b) is a private business development company

as defined in Section 202(a)(22) of the Investment Advisers Act of 1940;

(c) is an organization described in Section

501(c)(3) of the Internal Revenue Code of 1986, as amended (the “Code”), a

corporation, Massachusetts or similar business trust, or a partnership, not

formed for the specific purpose of acquiring the Securities offered, with total

assets in excess of $”AMOUNT OF OFFERING”;

(d) is a director, executive officer or

general partner of the Company, or any director, executive officer, or a

general partner of a general partner of the Company;

(e) is a natural person whose individual net

worth, individually or together with his or her spouse, exceeds “PRICE”,000,000

at the time of his or her purchase;

(f) (i) is a natural person

who had an individual income in excess of $200,000 in both 1998 and 1999

and who reasonably expects reaching the same income level in 2000; or

(ii) is a natural

person who had a joint income with his or her spouse in excess of $300,000 in

both 1998 and 1999 and who reasonably expects reaching the same income level in

2000;

(g) is a trust, with total assets in excess

of $”AMOUNT OF OFFERING”, not formed for the specific purpose of acquiring the

Securities offered, whose purchase is directed by a person who either alone or

with his purchaser representative has such knowledge and experience in

financial and business matters that he or she is capable of evaluating the

merits and risks of the prospective investment, or that the Company reasonably

believes immediately prior to making any sale that such purchaser comes within

this definition;

(h) is an entity in which all of the equity

owners are Accredited Investors meeting one or more of the tests under

subparagraphs (a) - (g).

2. The undersigned understands that this is a

highly speculative investment with a substantial risk of loss of its, his or

her (as the case may be) entire investment. The undersigned is in a position

to bear the economic risk of such loss. The undersigned acknowledges that the

Securities are subject to restrictions on transferability and resale pursuant

to that certain Stockholders’ Agreement among the Company, the undersigned and

certain other stockholders of the Company.

3. The undersigned hereby acknowledges that it,

he or she is acquiring the Securities for its, his or her (as the case may be)

own account for investment and not with a view toward distribution.

4. The undersigned hereby represents that by

reason of its, his or her (as the case may be) financial experience, or the

business and financial experience of its management, the undersigned has the

capacity to protect its, his or her (as the case may be) own interests in

connection with the transaction contemplated by the Subscription Agreement.

The undersigned was not formed for the specific purpose of consummating the

transactions contemplated by the Subscription Agreement.

5. The undersigned acknowledges that it, he or

she (as the case may be) has been given access to all Company documents,

records, and other information, has received physical delivery of all those

which the undersigned has requested, and has had adequate opportunity to ask

questions of, and receive answers from, the Company’s officers, employees,

agents, accountants, and representatives concerning the Company’s business,

operations, financial condition, assets, liabilities, and all other matters

relevant to the investment by the undersigned in the Company.

[Remainder of Page

Intentionally Blank]

IN WITNESS WHEREOF, the undersigned has executed this

Investor Questionnaire this ______ day of __________, “YEAR”.

|

|

If Natural Person:

|

|

|

Signature

|

|

|

|

|

|

Please Print Signature as Signed

|

|

|

|

|

|

Date

|

|

|

|

|

|

Signature

of Joint Tenant, if Applicable

|

|

|

|

|

|

Please

Print Signature as Signed

|

|

|

|

|

|

Date

|

|

|

|

|

|

If Entity:

|

|

|

|

|

|

Please Print Name of Partnership,

Corporation, Trust or Entity

|

|

|

|

|

|

By:

|

|

|

|

Signature

of Authorized Signatory

|

|

|

|

|

|

Please Print Name of Authorized

Signatory

|

|

|

|

|

|

Please Print Capacity of

Authorized Signatory

|

|

|

|

|

|

Date

|

EXHIBIT 2

TO

“COMPANY NAME”,

SUBSCRIPTION AGREEMENT

STOCKHOLDERS’ AGREEMENT

[INTENTIONALLY OMITTED]

STOCKHOLDERS’ AGREEMENT

“COMPANY NAME”

This Stockholders’ Agreement (this “Agreement”) is made as

of “DATE”th, “YEAR” by and among “COMPANY NAME”, a “STATE”

corporation (the “Company”), the holders of the Company’s Common Stock, par

value $.001 per share (the “Common Stock”) signatory to this Agreement and any

transferees of such holders (the “Investors”) and founders and management

stockholders of the Company listed on Exhibit 1 hereto (the “Key Stockholders”

and together with the Investors, the “Stockholders”).

WHEREAS, contemporaneously with the execution and delivery

of this Agreement, the Investors are acquiring shares (the “Shares”) of Common

Stock pursuant to Subscription Agreements (the “Subscription Agreements”)

between each such Investor and the Company;

WHEREAS, as a condition precedent to acquiring the Shares,

the Investors desire that the parties hereto enter into this Agreement.

NOW, THEREFORE, in consideration of the foregoing and

other good and valuable consideration, the receipt and sufficiency of which are

hereby acknowledged, the parties hereto agree as follows:

(a) “Affiliate”: With reference to any Person, a

spouse of such Person, any relative (by blood, adoption or marriage) of such

Person within the second degree, any director, officer or employee of such

Person or any of its Affiliates, any other Person of which such Person is a

general partner, managing member, manager, director, officer or employee, and

any other Person directly or indirectly controlling or controlled by or under

direct or indirect common control with such Person.

(b) “Co-Sale Stock” shall mean shares of the Company’s

Common Stock and Convertible Securities now owned or subsequently acquired by

any Key Stockholder. The number of shares of Co-Sale Stock owned by each Key

Stockholder as of the date hereof is set forth on Exhibit 1, which

Exhibit shall be amended from time to time to reflect changes in the number of

shares owned by the Key Stockholders.

(c) “Convertible Securities” shall mean options,

warrants, convertible securities or other rights convertible into or

exercisable for Common Stock.

(d) “Holder” shall mean any Investor owning of record

Registrable Securities that have not been sold to the public pursuant to the

Company’s Initial Public Offering or any assignee of record of such Registrable

Securities in accordance with Section 2(e) hereof.

(e) “Initial Public Offering” shall mean the initial

registered offering and sale of the Company’s Common Stock under the Securities

Act.

(f) “Liens” shall mean any and all liens, claims,

options, charges, encumbrances, voting trusts, irrevocable proxies or other

rights of any kind or nature.

(g) “Person” shall mean an individual, a partnership,

a joint venture, a corporation, a limited liability company, a trust, an

unincorporated organization or other entity or a government or any department

or agency thereof.

(h) “Registrable Securities” shall mean (a) shares of

Common Stock owned of record by the Holders and (b) any Common Stock of the

Company issued as (or issuable upon the conversion or exercise of any warrant,

right or other security which is issued as) a dividend or other distribution

with respect to, or in exchange for or in replacement of, such above-described

securities.

(i) “Securities Act” shall mean the Securities Act of

1933, as amended.

(j) “Transfer” shall mean any direct or indirect disposition

of an interest whether by sale, exchange, merger, consolidation, transfer,

assignment, conveyance, distribution, pledge, inheritance, gift, mortgage, the

creation of any security interest in, or Lien upon, any other disposition of

any kind and in any manner, by operation of law or otherwise.

(a) The Company shall promptly notify all Holders of

Registrable Securities in writing at least thirty (30) days prior to the filing

of any registration statement under the Securities Act for purposes of a public

offering (other than the Initial Public Offering) of securities of the Company

(including, but not limited to, registration statements relating to secondary

offerings of securities of the Company on behalf of security holders of the

Company, but excluding registration statements relating to employee benefit

plans, dividend reinvestment plans, mergers, acquisitions, exchange offers,

corporate reorganizations or similar corporate transactions) and will afford

each such Holder an opportunity to include in such registration statement all

or part of such Registrable Securities held by such Holder. Each Holder

desiring to include in any such registration statement all or any part of the

Registrable Securities held by it shall, within twenty (20) days after receipt

of the above-described notice from the Company, so notify the Company in

writing. Such notice shall state the intended method of disposition of the

Registrable Securities by such Holder. If a Holder decides not to include all

of its Registrable Securities in any registration statement thereafter filed by

the Company, such Holder shall nevertheless continue to have the right to

include any Registrable Securities in any subsequent registration statement or

registration statements as may be filed by the Company with respect to

offerings of its securities, all upon the terms and conditions set forth

herein.

(b) If the registration statement under

which the Company gives notice under this Section 2 is for an underwritten

offering, the Company shall so advise the Holders of Registrable Securities.

In such event, the right of any such Holder to be included in a registration pursuant

to this Section 2 shall be conditioned upon such Holder’s participation in such

underwriting and the inclusion of such Holder’s Registrable Securities in the

underwriting to the extent provided herein. All Holders proposing to

distribute their Registrable Securities through such

underwriting shall enter into an underwriting agreement in customary form

with the underwriter or underwriters selected for such underwriting.

(c) If the Company or the managing underwriter, if any,

determines in good faith that market conditions and similar factors require a

limitation of the number of shares to be offered, and the offering was

initiated by the Company for its own account, the number of shares that may be

included in the offering shall be allocated, first, to the Company for its own

account; second, to the Holders on a pro rata basis based on the total number

of Registrable Securities held by the Holders; and third, to any stockholder

(other than a Holder) invoking contractual rights to have their securities registered,

if any, on a pro rata basis. No such reduction shall reduce the securities

being offered by the Company for its own account to be included in the

registration and underwriting. If the Company or the managing underwriter, if

any, determines in good faith that market conditions and similar factors

require a limitation of the number of shares to be offered, and the offering

was initiated for the account of any stockholders invoking contractual rights

to have their securities registered, the number of shares that may be included

in the offering shall be allocated, first, to such stockholders, on a pro rata

basis; second, to the Holders on a pro rata basis based on the total number of

Registrable Securities held by the Holders; and third, to the Company. If any

Holder disapproves of the terms of any such offering, it may elect to withdraw

therefrom by written notice to the Company and the underwriter, if applicable.

Any Registrable Securities excluded or withdrawn from such offering shall be

withdrawn from the registration.

(d) The Company shall bear all fees and expenses incurred in

connection with any registration under this Section 2, including without

limitation all registration, filing, qualification, printers’ and accounting

fees, fees and disbursements of counsel to the Company, and the reasonable fees

and disbursements of a single counsel to the selling Holders, except that each

participating Holder shall bear its proportionate share of all amounts payable

to underwriters in connection with such offering for discounts and commissions.

(e) The Company shall have the right to terminate or withdraw

any registration initiated by it under this Section 2 prior to the

effectiveness of such registration, whether or not any Holder has elected to

include securities in such registration.

(f) The rights to cause the Company to register Registrable

Securities pursuant to this Section 2 may be assigned by a Holder to a

transferee or assignee of Common Stock, and the Company shall promptly be

furnished with written notice of the name and address of such transferee or

assignee and the securities with respect to which such registration rights are

being assigned; provided, however, that no such assignment or

Transfer may be made to (i) a transferee who acquired less than two percent

(2%) of the total number of Shares originally issued to the Investors or (ii) a

competitor of the Company. Notwithstanding the foregoing, rights to cause the

Company to register securities may be assigned to an Affiliate of a Holder

without restriction as to minimum Share ownership.

(g) All registration rights granted under

this Section 2 shall terminate and be of no further force and effect on the

earlier of (i) the date four (4) years following the Company’s Initial Public

Offering or (ii) with respect to a particular Holder, the date the Registrable

Securities held by such Holder may be sold in a single transaction pursuant

to Rule 144 under the Securities Act.

(h) Each Holder hereby agrees that during the one hundred

eighty (180) day period following the effective date of a registration

statement of the Company filed under the Securities Act relating to the

Company’s Initial Public Offering, it shall not, to the extent requested by the

Company or the managing underwriter, if any, sell or otherwise Transfer or

dispose of (other than to donees who agree to be similarly bound) any

securities of the Company held by it at any time during such period. In order

to enforce the foregoing covenant, the Company may impose stop-Transfer

instructions with respect to the Registrable Securities of each Holder (and the

shares or securities of every other Person subject to the foregoing

restriction) until the end of such period.

(i) Obligations of the Company. Whenever required to

effect the registration of any Registrable Securities, the Company shall:

(i) Prepare and file with the Securities and Exchange

Commission (the “SEC”) a registration statement with respect to such

Registrable Securities and use its best efforts to cause such registration

statement to become effective, and, upon the request of the Holders of a

majority of the Registrable Securities registered thereunder, keep such

registration statement effective for up to thirty (30) days.

(ii) Prepare and file with the SEC such amendments and

supplements to such registration statement and the prospectus used in

connection with such registration statement as may be necessary to comply with

the provisions of the Securities Act with respect to the disposition of all

securities covered by such registration statement.

(iii) Furnish to the Holders such number of copies of a

prospectus, including a preliminary prospectus, in conformity with the

requirements of the Securities Act, and such other documents as they may

reasonably request in order to facilitate the disposition of Registrable Securities

owned by them.

(iv) Use its best efforts to register and qualify the

securities covered by such registration statement under such other securities

or Blue Sky laws of such jurisdictions as shall be reasonably requested by the

Holders, provided that the Company shall not be required in connection

therewith or as a condition thereto to qualify to do business or file a general

consent to service of process in any such states or jurisdictions.

(v) In the event of any underwritten public offering, enter

into and perform its obligations under an underwriting agreement, in usual and

customary form, with the managing underwriter(s) of such offering. Each Holder

participating in such underwriting shall also enter into and perform its

obligations under such an agreement.

(vi) Notify each Holder of Registrable

Securities covered by such registration statement at any time when a prospectus

relating thereto is required to be delivered under the Securities Act of the

happening of any event as a result of which the prospectus included in such

registration statement, as then in effect, includes an untrue statement of a

material fact or omits to state a material fact required to be stated

therein or necessary to make the statements therein not misleading in the light

of the circumstances then existing.

(vii) Make available for inspection by any Investor, any

underwriter participating in any disposition pursuant to such registration

statement and any attorney, accountant or other agent retained by the Investors

or underwriter (collectively, the “Inspectors”), all pertinent financial and

other records, pertinent corporate documents and properties of the Company, as

shall be reasonably necessary to enable them to exercise their due diligence

responsibility, and cause the Company’s officers, directors and employees to

supply all information reasonably requested by any such Inspector in

connection with such registration statement; provided, however,

that the Company shall not be obligated to provide access to any information

which it reasonably considers to be a trade secret or similar confidential

information unless the recipient of such information executes a nondisclosure

agreement in a form reasonably acceptable to the Company.

(j) In connection with the obligations of the Company to

take any action pursuant to this Section 2, the selling Holders shall furnish

to the Company such information regarding themselves, the Registrable

Securities held by them, and the intended method of disposition of such

securities as shall be required to effect the registration of their Registrable

Securities.

(k) Indemnification. In the event any Registrable

Securities are included in a registration statement under this Section 2, the

following indemnification provisions shall apply:

(i) To the extent permitted by law, the

Company will indemnify and hold harmless each Holder, the partners, Affiliates,

officers and directors of each Holder, any underwriter (as defined in the

Securities Act) for such Holder and each Person, if any, who controls such

Holder or underwriter within the meaning of the Securities Act or the

Securities Exchange Act of 1934, as amended (the “1934 Act”), against any

losses, claims, damages or liabilities (joint or several) to which they may

become subject under the Securities Act, the 1934 Act or other federal or state

law, insofar as such losses, claims, damages, or liabilities (or actions in

respect thereof) arise out of or are based upon any of the following

statements, omissions or violations (collectively, a “Violation”) by the

Company: (i) any untrue statement or alleged untrue statement of a material

fact contained in such registration statement, including any preliminary

prospectus or final prospectus contained therein or any amendments or

supplements thereto, (ii) the omission or alleged omission to state therein a

material fact required to be stated therein, or necessary to make the

statements therein not misleading, or (iii) any violation or alleged violation

by the Company of the Securities Act, the 1934 Act, any state securities law or

any rule or regulation promulgated under the Securities Act, the 1934 Act or

any state securities law in connection with the offering covered by such

registration statement; and the Company will reimburse each such Holder,

partner, Affiliate, officer or director, underwriter or controlling Person for

any legal or other expenses reasonably incurred by them in connection with

investigating or defending any such loss, claim, damage, liability or action; provided,

however, that the indemnity agreement contained in this Section 2(k)(i)

shall not apply to amounts paid in settlement of any such loss, claim, damage,

liability or action if such settlement is effected without the consent of the

Company (which consent shall not be unreasonably withheld or

delayed), nor shall the Company be liable in any such case for any such

loss, claim, damage, liability or action to the extent that it arises out of or

is based upon a Violation which occurs in reliance upon and in conformity with

written information furnished expressly for use in connection with such

registration by such Holder.

(ii) To the extent permitted by law, each selling Holder will

indemnify and hold harmless the Company, each of its directors, each of its

officers, each Person, if any, who controls the Company within the meaning of

the Securities Act, any underwriter and any other Holder selling securities

under such registration statement or any of such other Holder’s partners,

Affiliates, directors or officers or any Person who controls such Holder,

against any losses, claims, damages or liabilities (joint or several) to which

the Company or any such director, officer, controlling Person, underwriter or

other such Holder, or partner, Affiliate, director, officer or controlling

Person of such other Holder may become subject under the Securities Act, the

1934 Act or other federal or state law, insofar as such losses, claims, damages

or liabilities (or actions in respect thereto) arise out of or are based upon

any Violation, in each case to the extent (and only to the extent) that such

Violation occurs in reliance upon and in conformity with written information

furnished by such Holder expressly for use in connection with such

registration; and each such Holder will reimburse any legal or other expenses

reasonably incurred by the Company or any such director, officer, controlling

Person, underwriter or other Holder, or partner, Affiliate, officer, director

or controlling Person of such other Holder in connection with investigating or

defending any such loss, claim, damage, liability or action if it is judicially

determined that there was such a Violation which occurred in reliance upon and

in conformity with written information furnished by such Holder expressly for

use in connection with such registration; provided, however, that

the indemnity agreement contained in this Section 2(k)(ii) shall not apply to

amounts paid in settlement of any such loss, claim, damage, liability or action

if such settlement is effected without the consent of the Holder, which consent

shall not be unreasonably withheld or delayed; provided, further,

that in no event shall any indemnity under this Section 2(k)(ii) exceed the net

proceeds from the offering received by such Holder.

(iii) Promptly after receipt by an

indemnified Party under this Section 2(k) of notice of the commencement of any

action (including any governmental action), such indemnified party will, if a

claim in respect thereof is to be made against any indemnifying party under

this Section 2(k), deliver to the indemnifying party a written notice of the

commencement thereof and the indemnifying party shall have the right to

participate in and, to the extent the indemnifying party so desires, jointly